The payment status will be tentatively displayed as processing until the bank settles the transaction. ACH bank transfers typically take 5-6 business days to settle.

ACH Direct Debit can be used to make payments with Stripe accounts in the following countries. Refer to the country availability section on this page - https://stripe.com/docs/payments/ach-debit

For ACH Debit transactions, Stripe charges differently than for usual cards or Google Pay/Apple Pay transactions. Refer here for the latest pricing from Stripe - https://stripe.com/en-gb-us/pricing#pricing-details

Accepting bank accounts is slightly different from accepting cards:

Your customer must authorize the payment terms.

Bank accounts must be verified.

Banks usually confirm ACH transactions within 4-5 business days since they are not real-time transactions. Hence, invoices paid using bank transfer will not get paid instantly but rather move into Payment Processing status. The status will update to success/failed after bank confirmation.

ACH Direct Debit transactions can fail at any time after payment confirmation. These failures can occur for a number of reasons, such as:

Insufficient funds

An invalid account number

A customer disabled debits from their bank account

If a payment fails after funds have been made available in your Stripe balance, Stripe immediately removes funds from your Stripe account.

Your customers can securely share their financial data with your business using Stripe. Use Financial Connections to access customer-permissioned financial data such as tokenized account and routing numbers, balance data, ownership details, and transaction data.

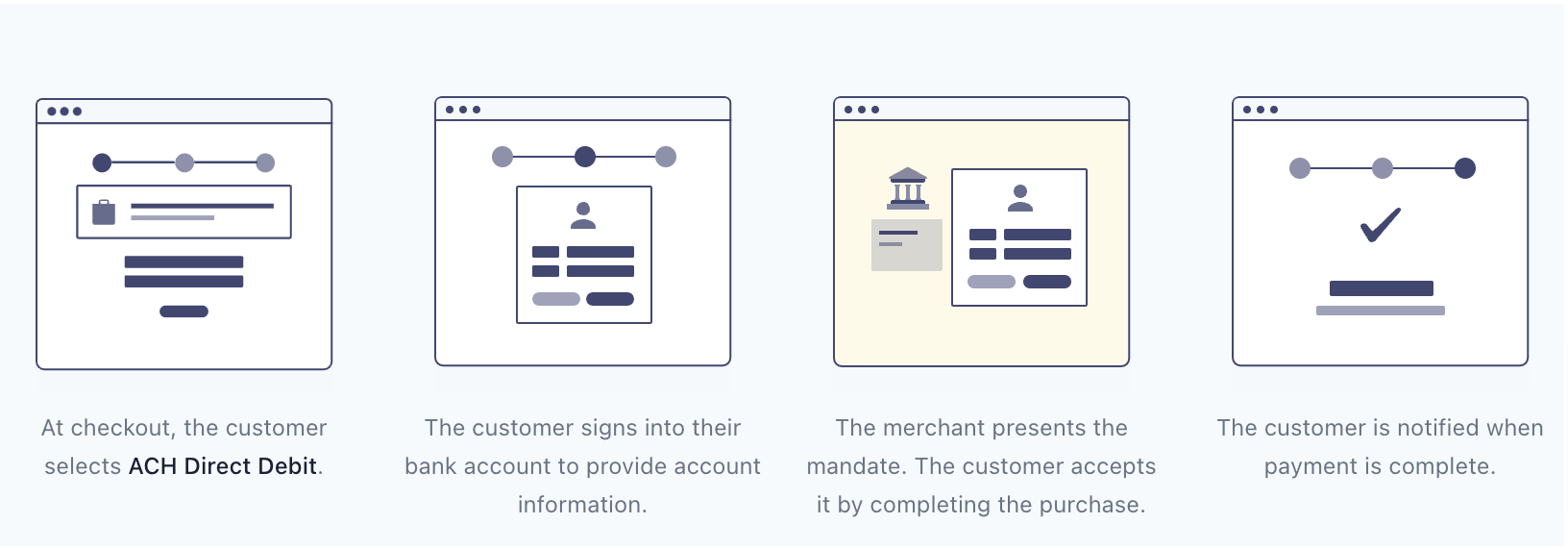

In order to debit a customer's bank account via ACH Direct Debit, you must first obtain permission from the customer. To get this permission, you present a mandate to them. This mandate specifies the terms for one-time or recurring payments. The customer must agree to this mandate before you can collect payments from their bank account.

We display this mandate on the payment page for you to allow leads to complete the payment process smoothly.

A: No, we are using Financial Connections as of now. Entering bank account details manually and authorizing with micro deposits is not available at the moment

A: Yes, Apple Pay and Google Pay option will still remain available for the customers alongside US Bank Accounts. This leaves the contact/lead to pay with any option - Cards, Apple Pay or Google Pay and US Bank accounts, provided the payment methods are supported in the respective geography.

A: We strongly recommend using US Bank Accounts as a payment method since more payment method choices leads to more conversions. If you still want to turn this off, you can do that in the Stripe Dashboard under Payment methods.