Topline OS now supports tax rates with 4-decimal precision. This reduces rounding errors on invoices, subscriptions, POS, and checkout, and keeps calculations consistent across items and reports.

Tax rates support up to four decimal places, for example 7.1250 percent

More accurate line item and total calculations across invoices, subscriptions, POS, and checkout

Consistent rounding logic applied at item and totals levels

Reports reflect the higher precision for cleaner reconciliation

Match local authority rates exactly, including fractional percentages

Use consistent precision across related taxes to avoid tiny variances

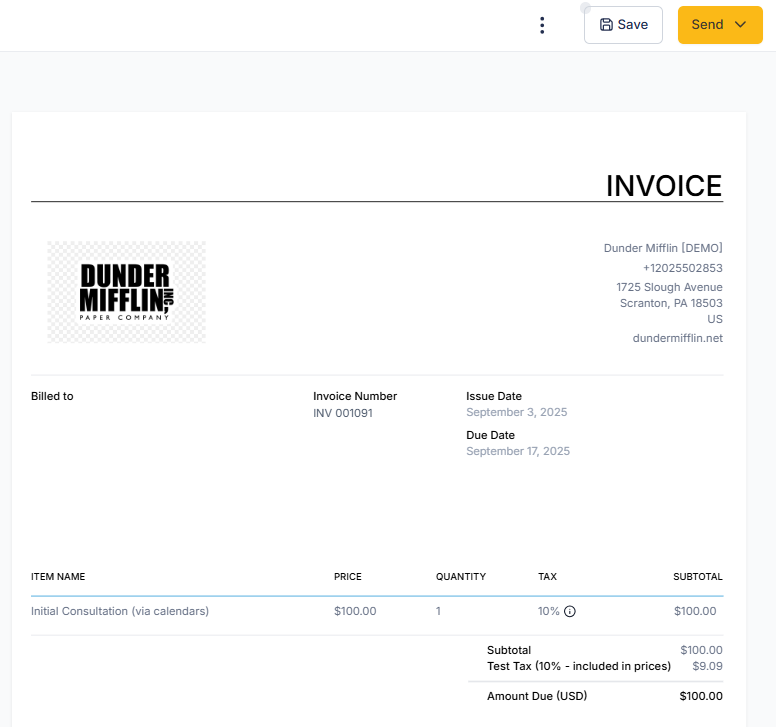

For price inclusive taxes, double check item prices and tax-inclusive totals after updating rates

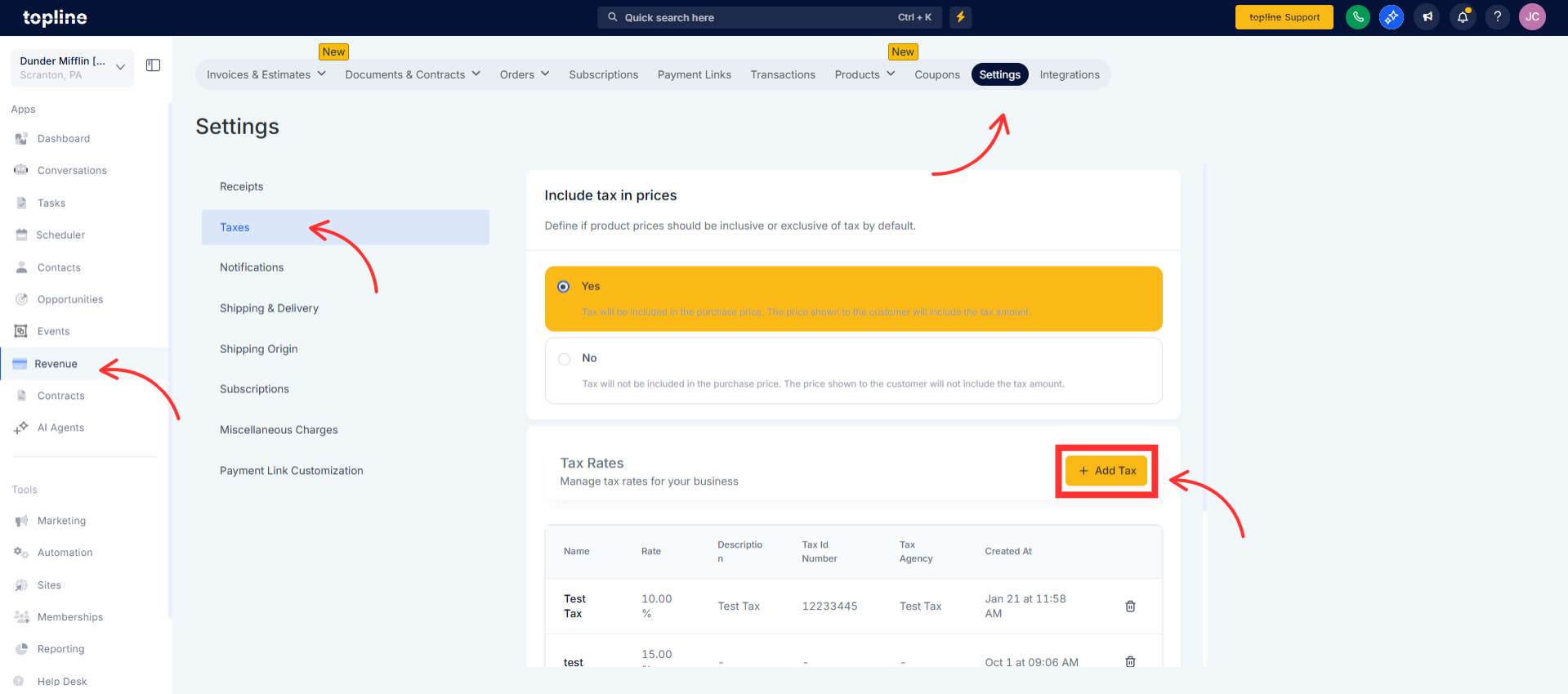

Step 1

Open Revenue → Taxes or Store → Settings → Taxes and Create a new tax or edit an existing one.

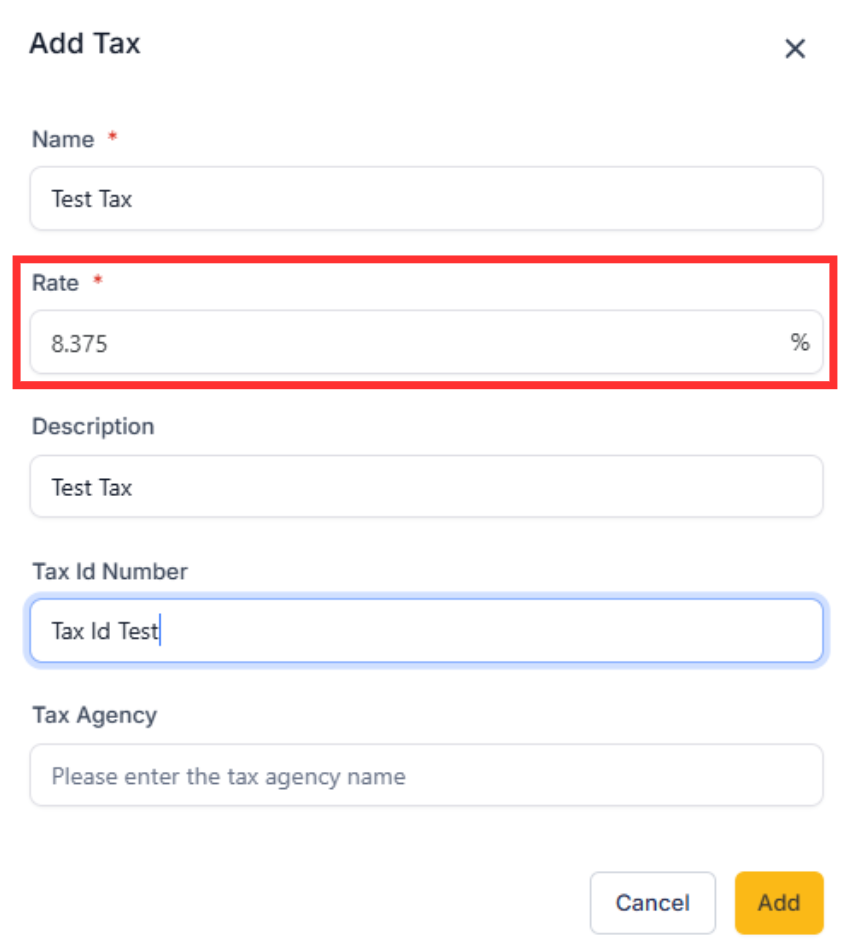

Step 2

Enter the precise rate with up to four decimals, for example 8.3750, and click on Add.

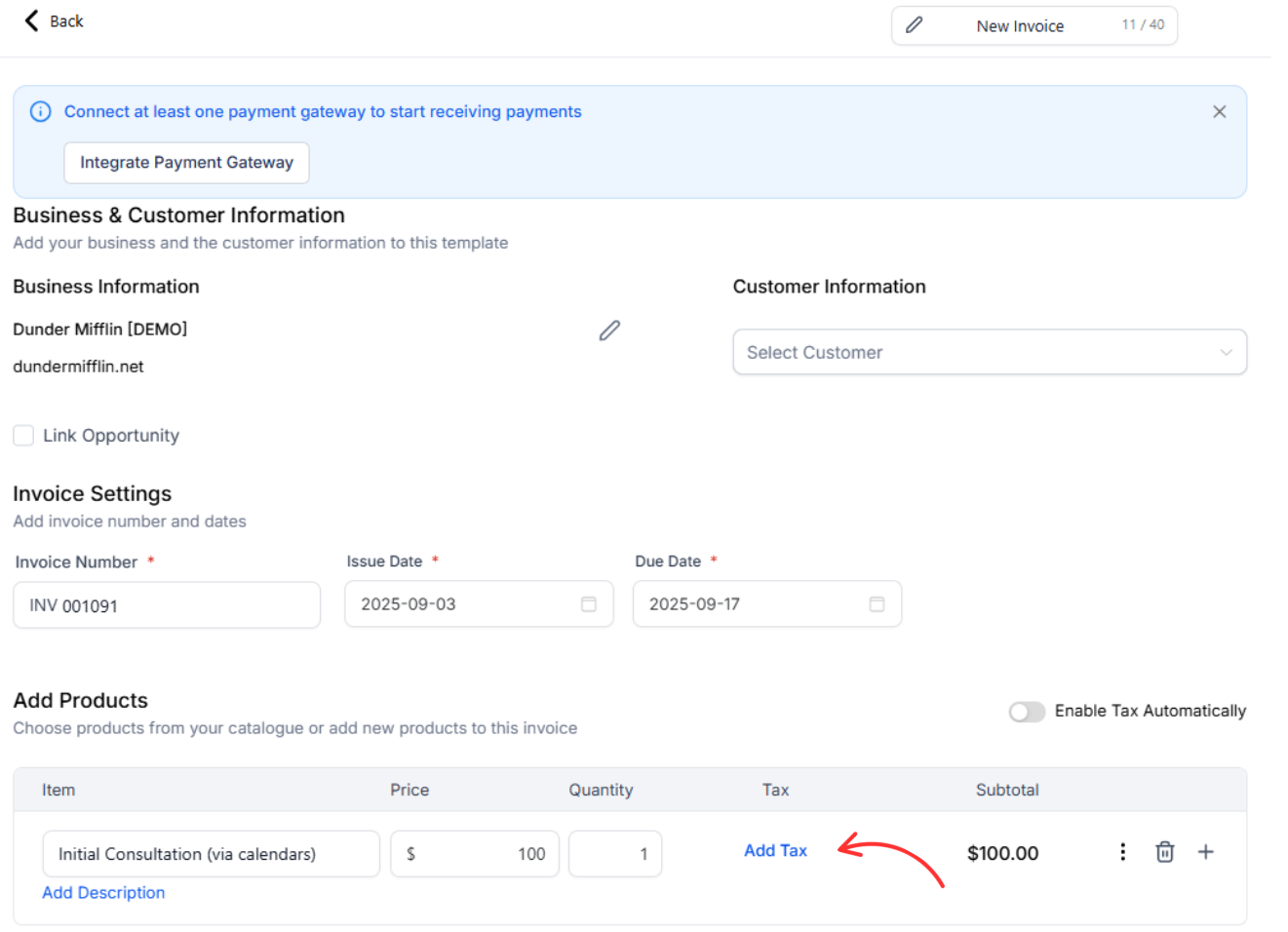

Step 3

Apply the tax to products, invoices, subscriptions, or checkout as you normally do.

Step 4

Create a test invoice or checkout to verify calculations and rounding look correct.

Can I use fewer than four decimals?

Yes. Enter as many decimals as your jurisdiction requires, up to four.

Does this change old invoices?

No. Previously issued invoices remain the same. New documents use the higher precision.

Where is the precision applied

At line items and totals for invoices, subscriptions, POS, and checkout.

Do I need to reassign taxes to products

No, unless you created new tax records. Editing an existing tax updates future calculations automatically.

Will exports match my accounting system

With higher precision, totals should align more closely. If your accounting tool rounds differently, set matching precision rules there.