Navigate to the Sites section on the left side menu.

Go to the Websites tab on the upper side of the page.

You can select your online store from the options.

You can see all the products by opening your product list page.

Access the products or content section.

Choose the item you want to purchase.

This allows customers to choose items to purchase without actually completing the payment.

You can then proceed to the checkout process once your item has been added to the cart.

The payment plan option allows you to offer flexible payments to your customers, allowing them to pay in smaller, more manageable amounts. It also allows you to spread out payments over a longer period of time, which can help to reduce your overall costs. Additionally, it can help to increase customer satisfaction, as customers are more likely to make a purchase if they can pay in installments.

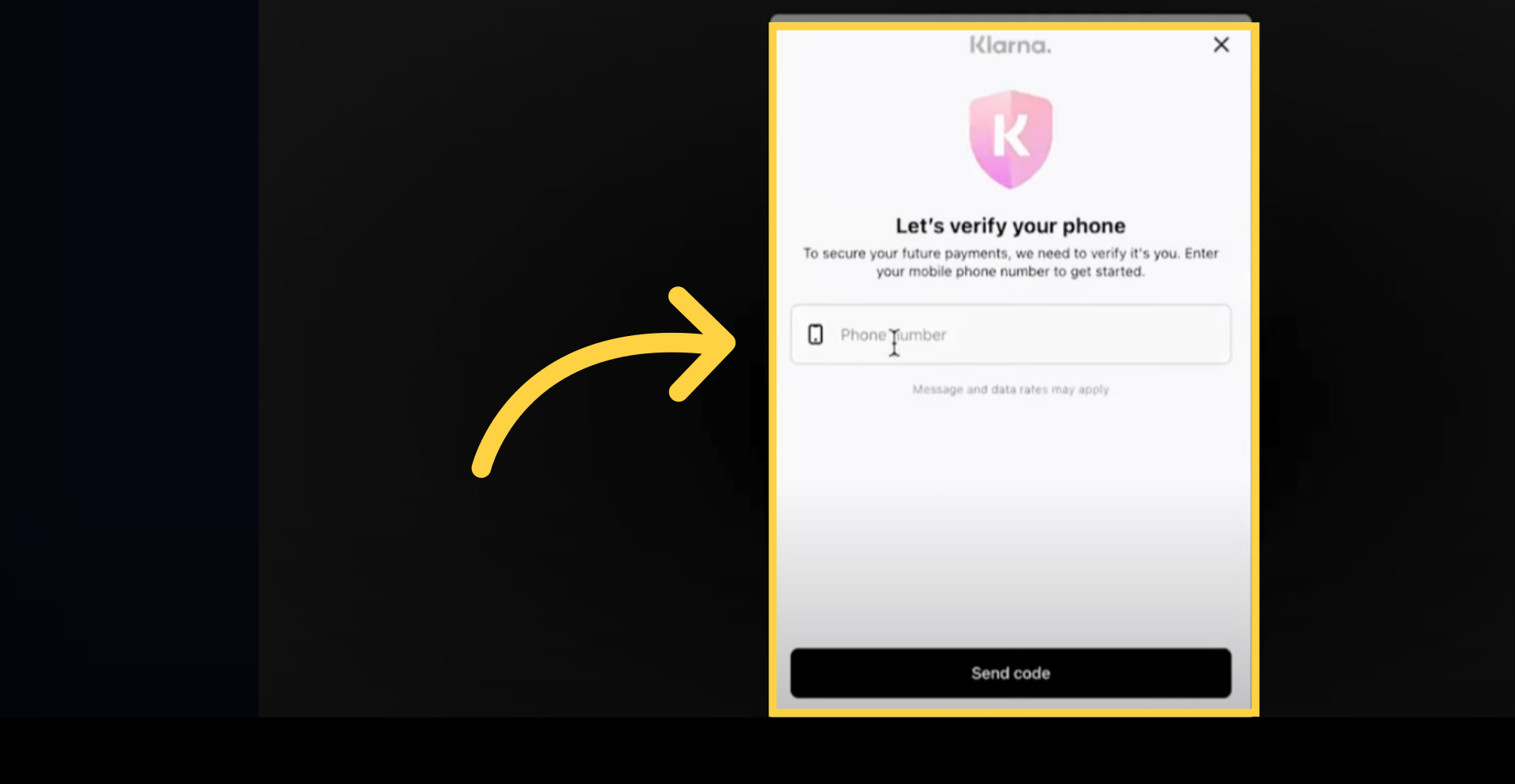

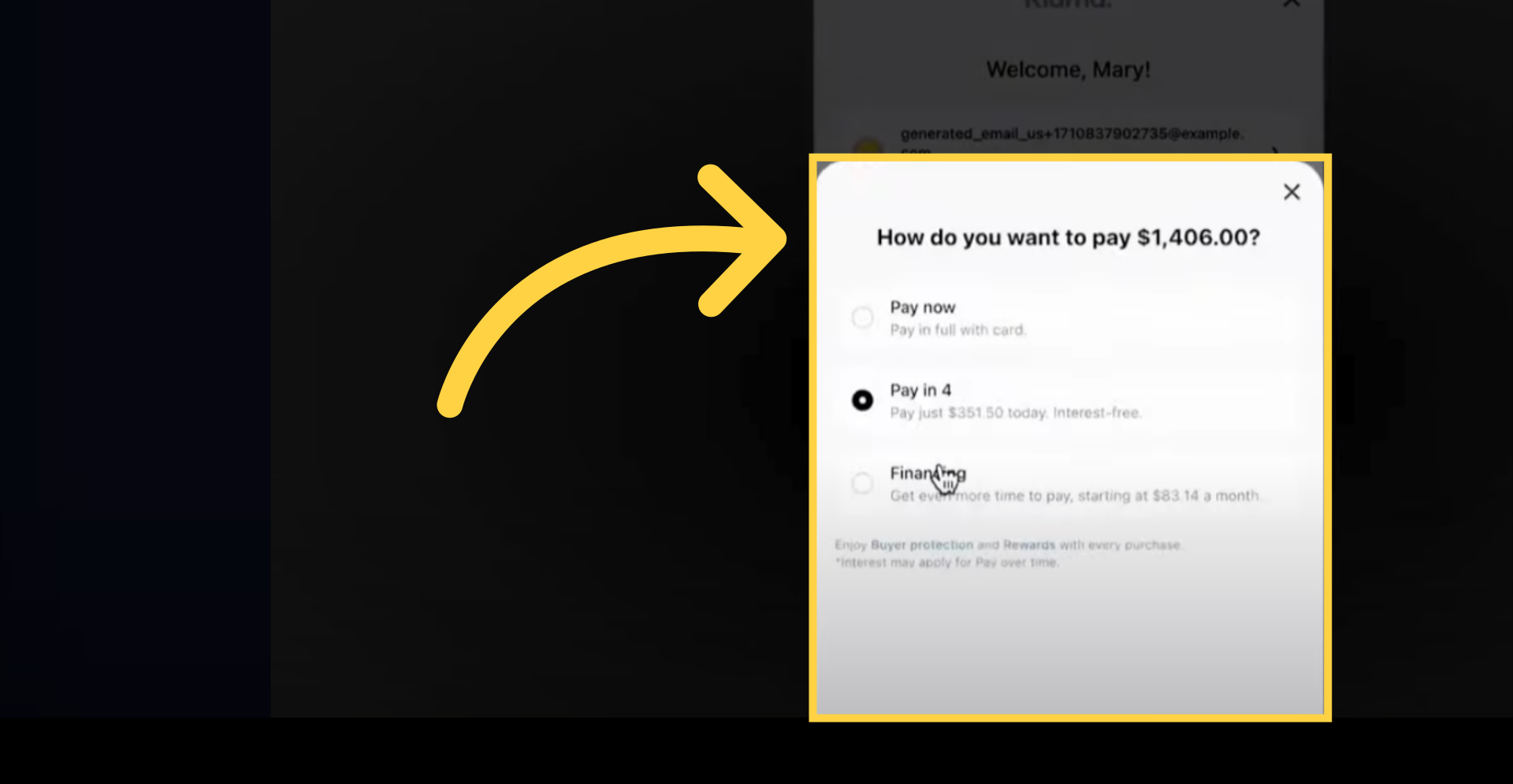

Upon selecting a payment plan, you will be prompted to register on a welcome page. To pay with Klarna, customers are redirected to Klarna’s site, where they select their preferred payment option, then return to your website to complete the order.

You will need to enter your phone number in order for your account to be verified.

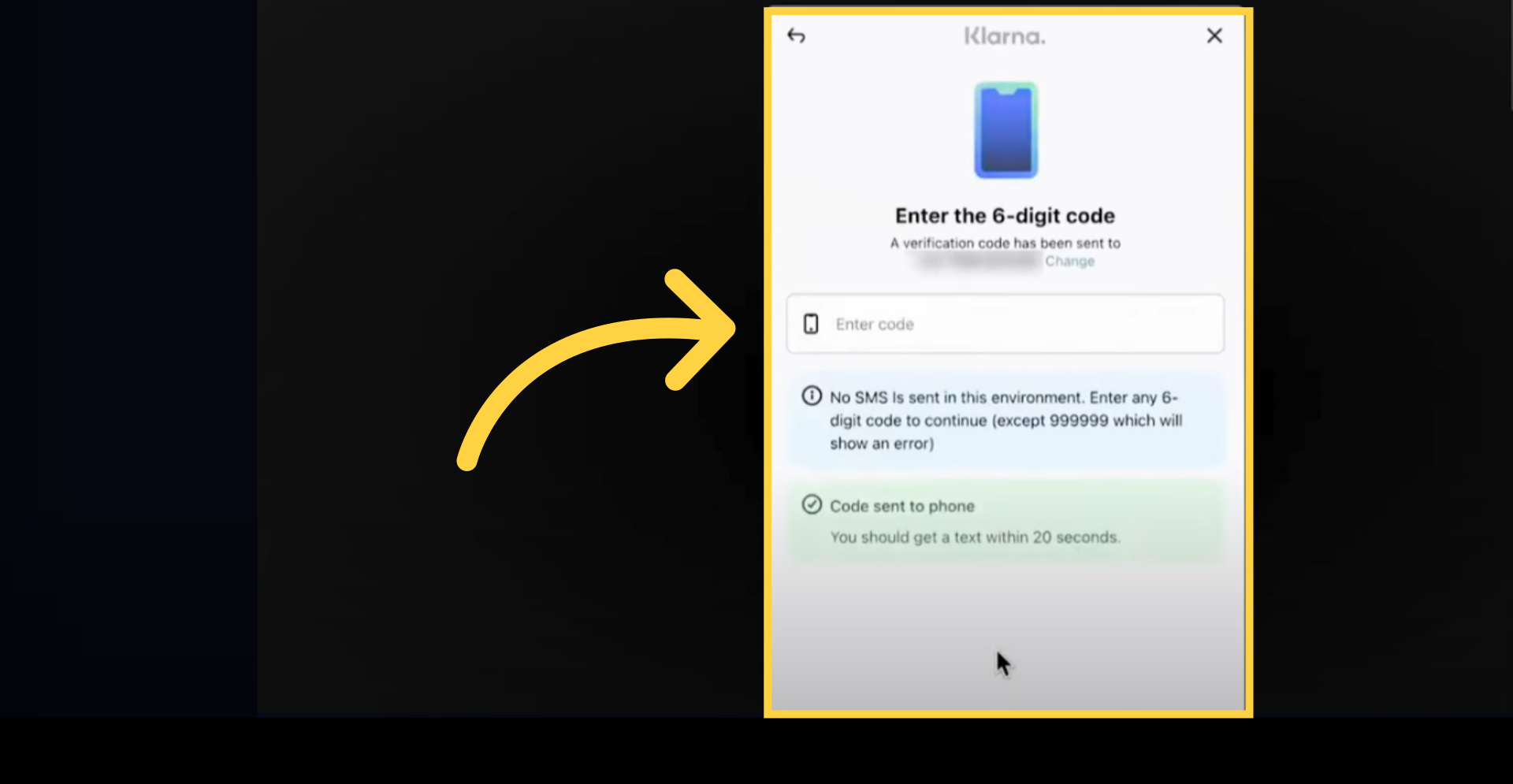

Enter the 6 digit code for verification.

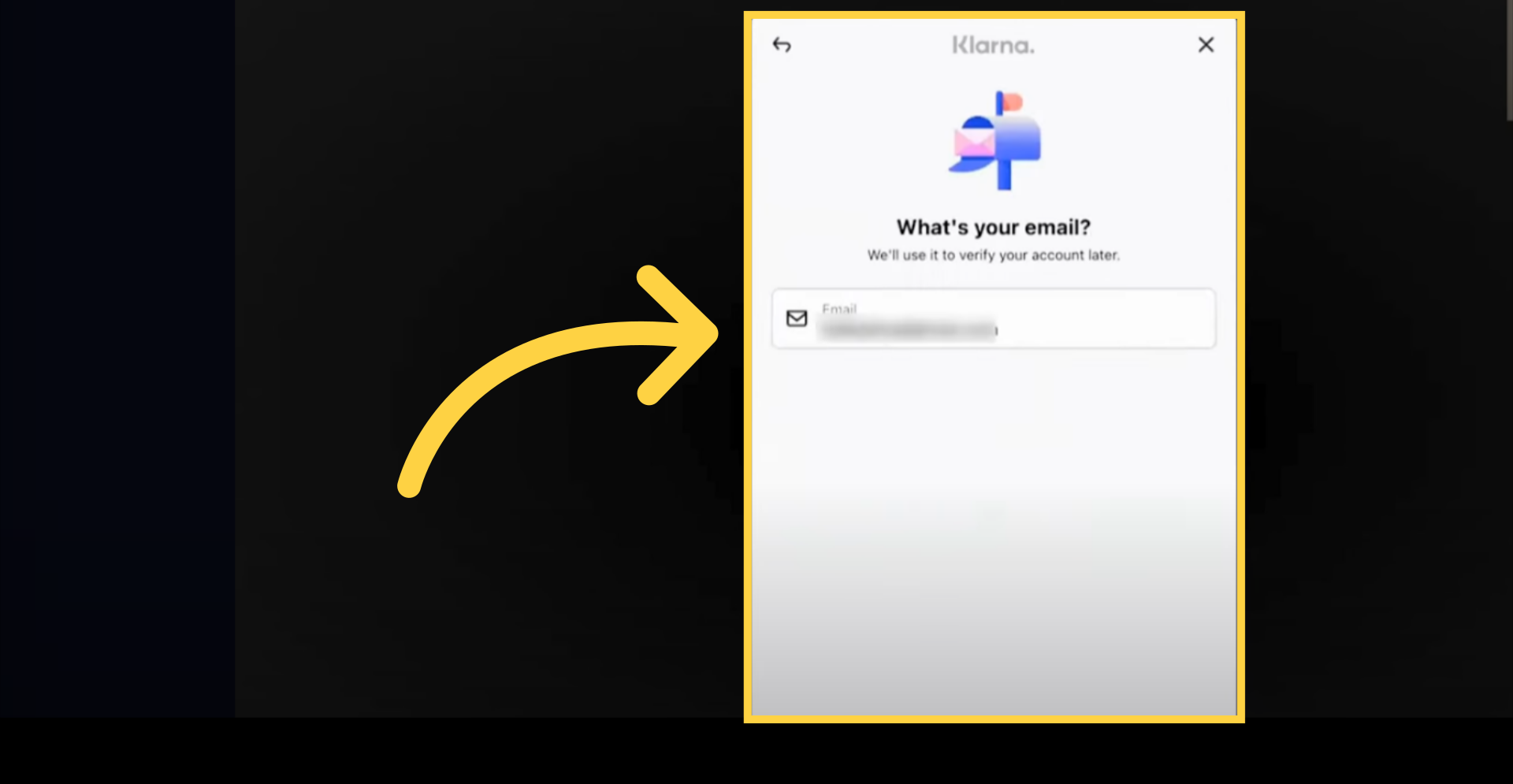

Enter your email to validate your account later.

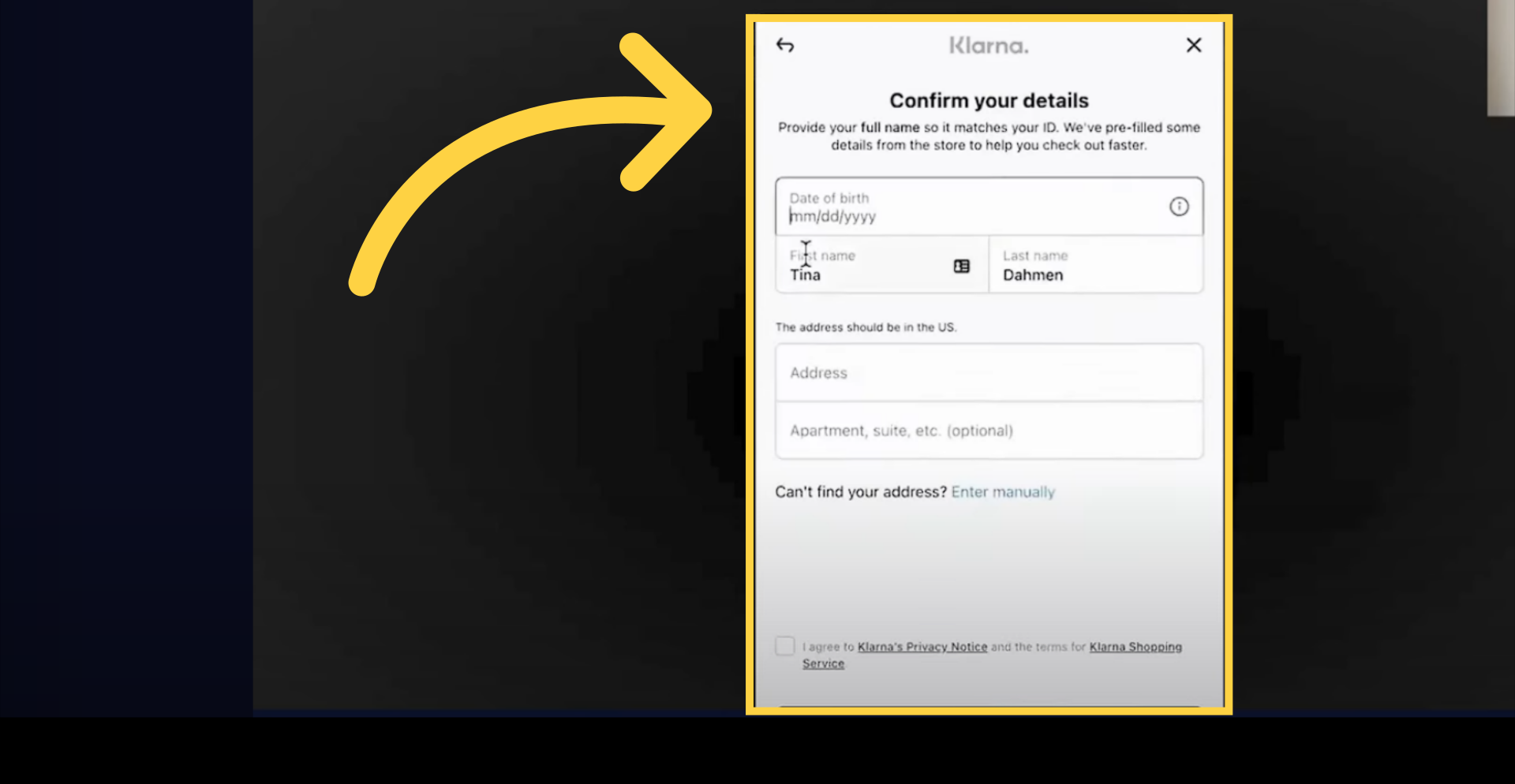

Provide your full name, date of birth and address so it matches your ID.

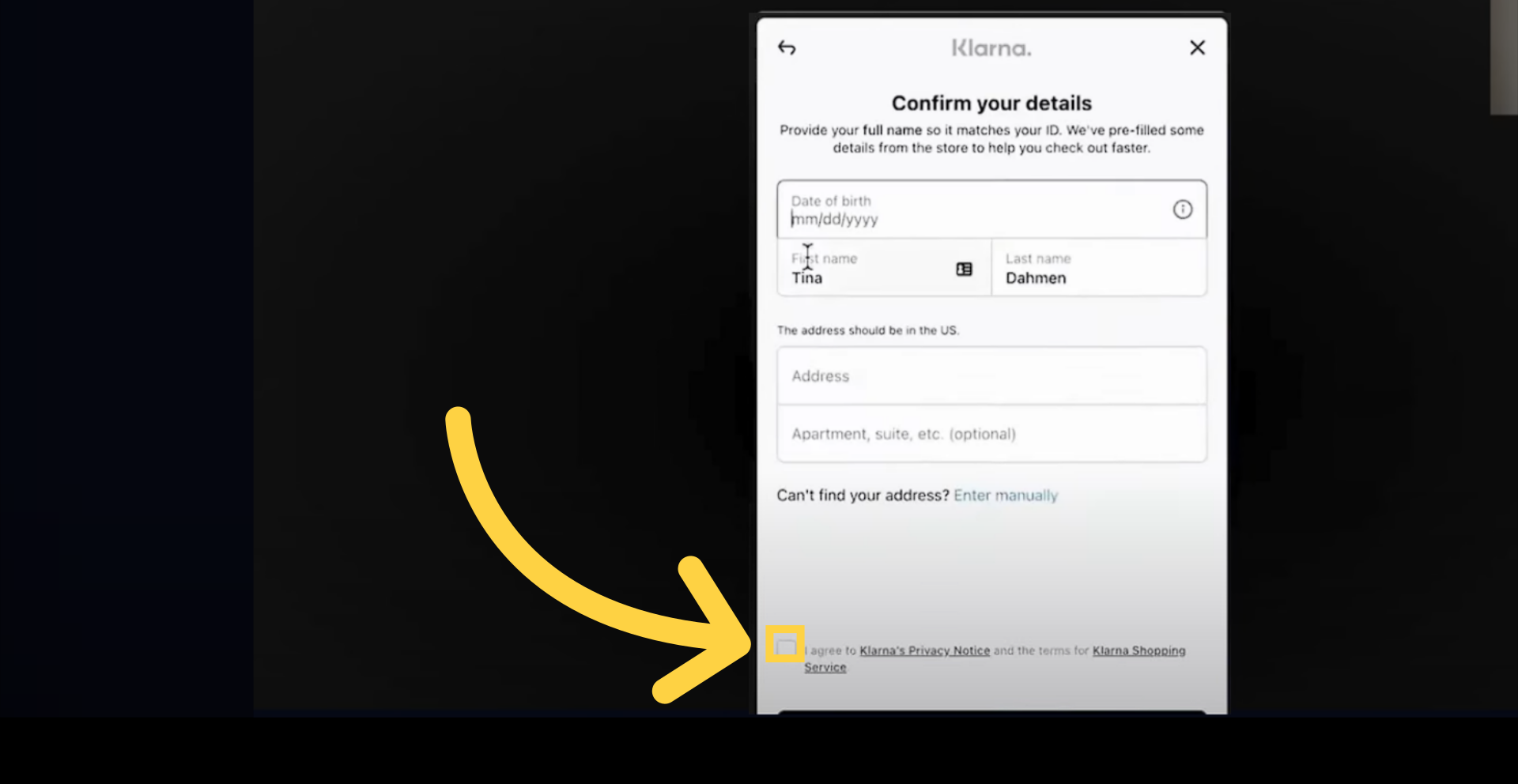

You can proceed by ticking the box and clicking the Create Klarna button.

Upon completion of your purchase, a pop-up window will tell you that your account is ready. Click "Continue" to proceed.

Depending on your needs, choose the one that is right for you. In this case, the payment options are as follows: pay now, pay in four (interest-free), or finance.

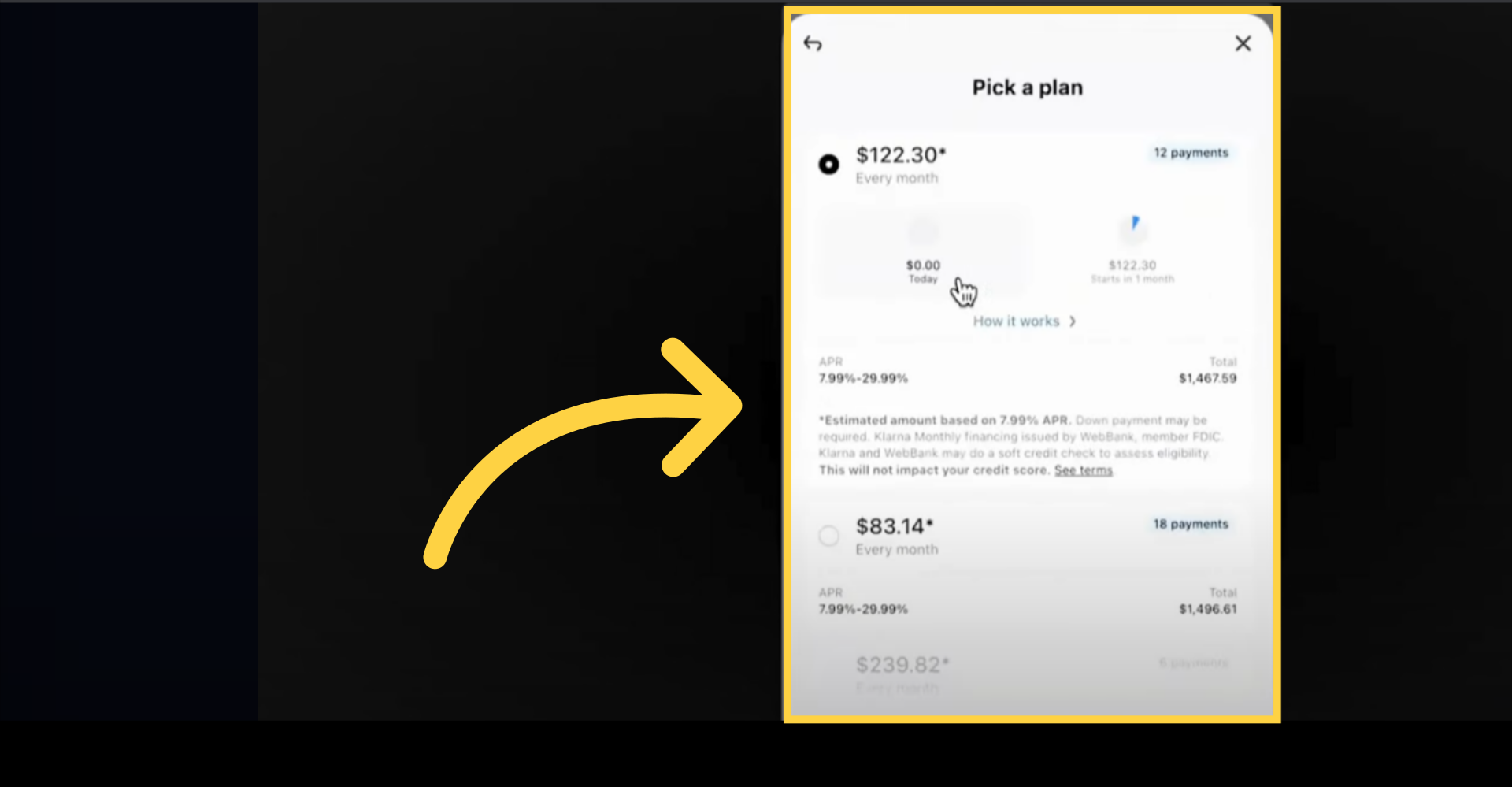

You can select the payment plan that is most convenient for you. In this section, you can find a payment schedule that shows you how much you will need to pay today and in a month's time.

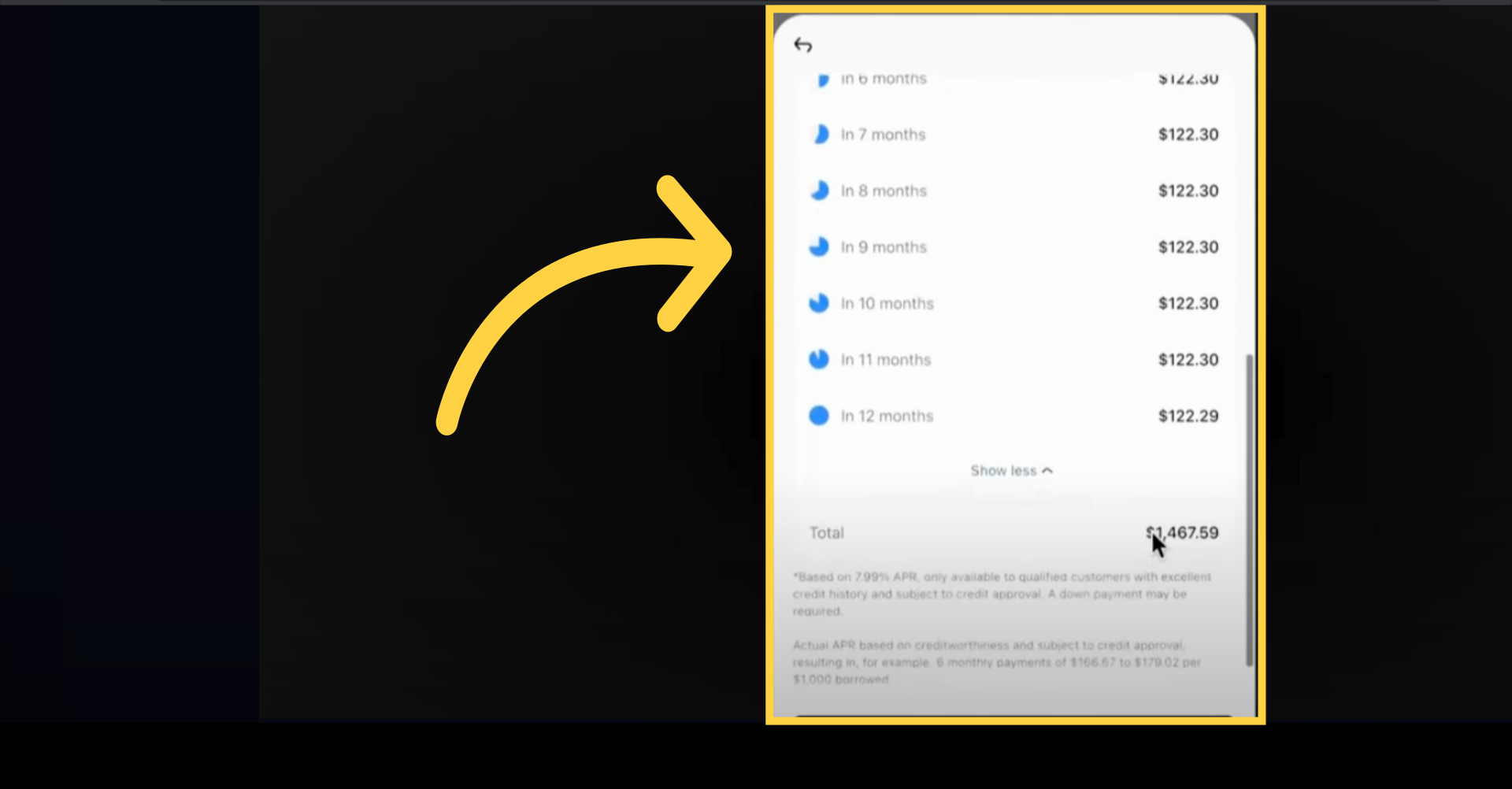

The monthly breakdown of your payment plan can be found here.

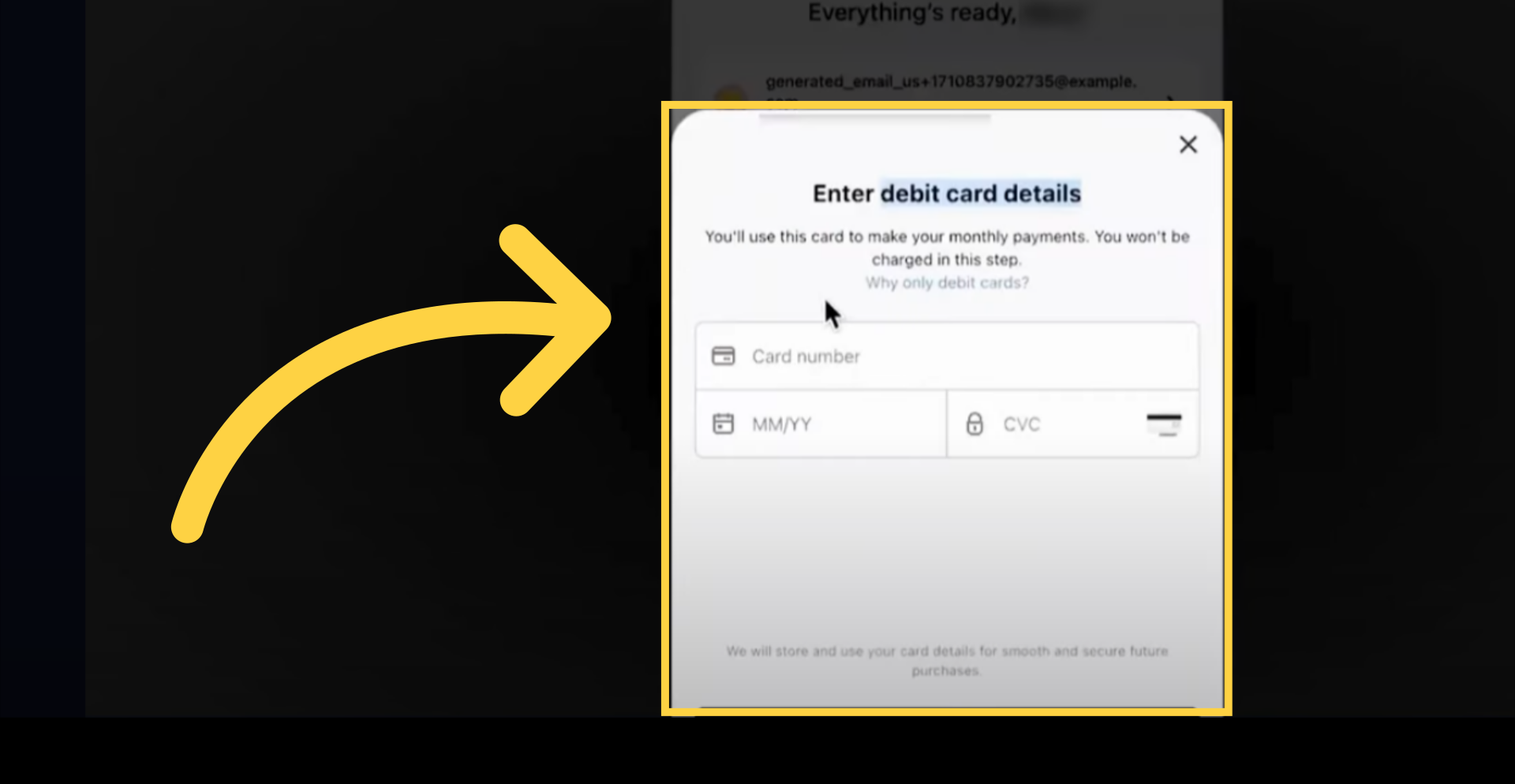

This will be the same card that you will use in your monthly payments. Note: A credit card won't work here. Debit cards are only accepted to pay back financed purchases.

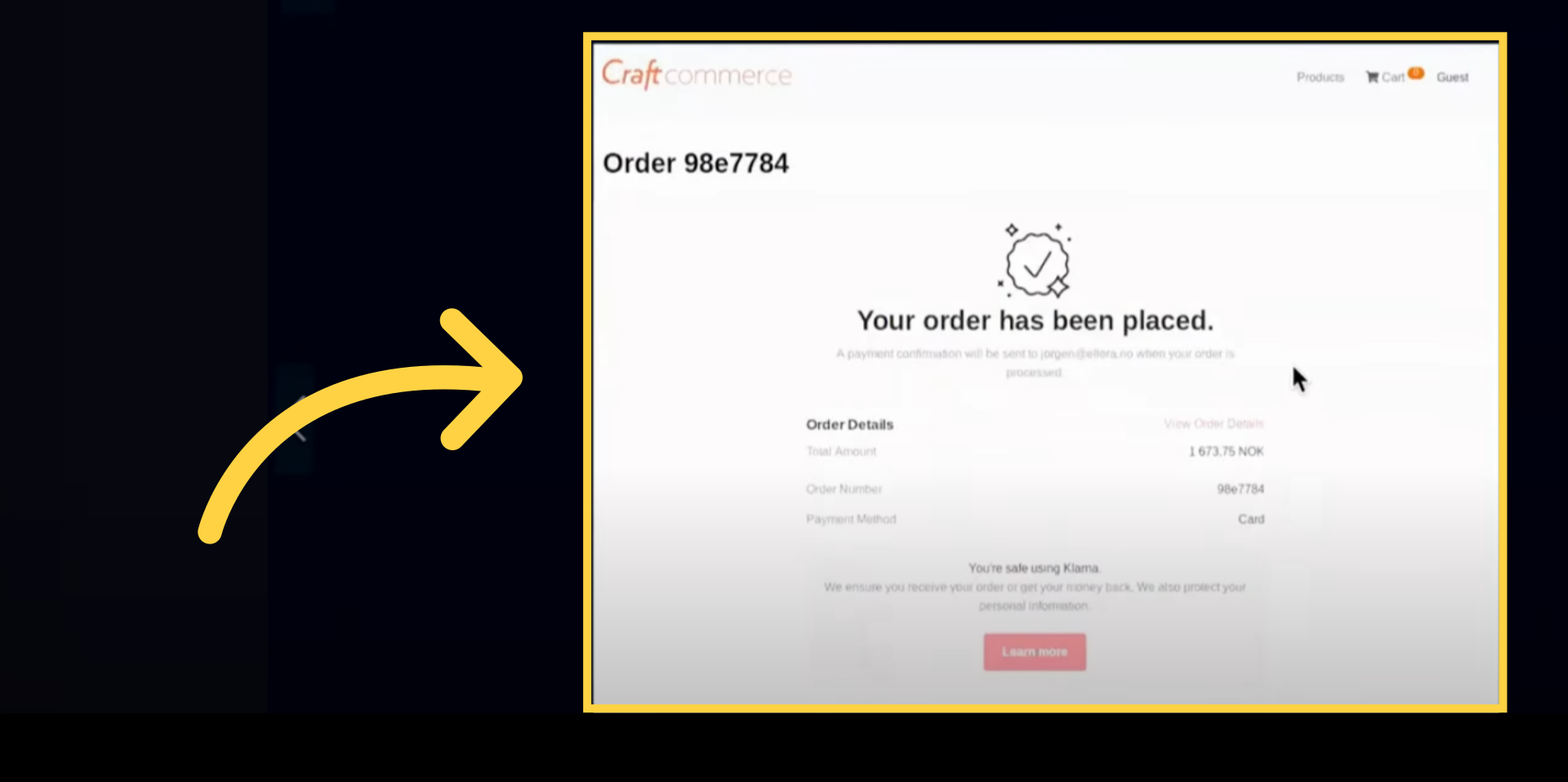

Once you have provided your card information, you will be redirected to a page where you will receive the confirmation of your order.

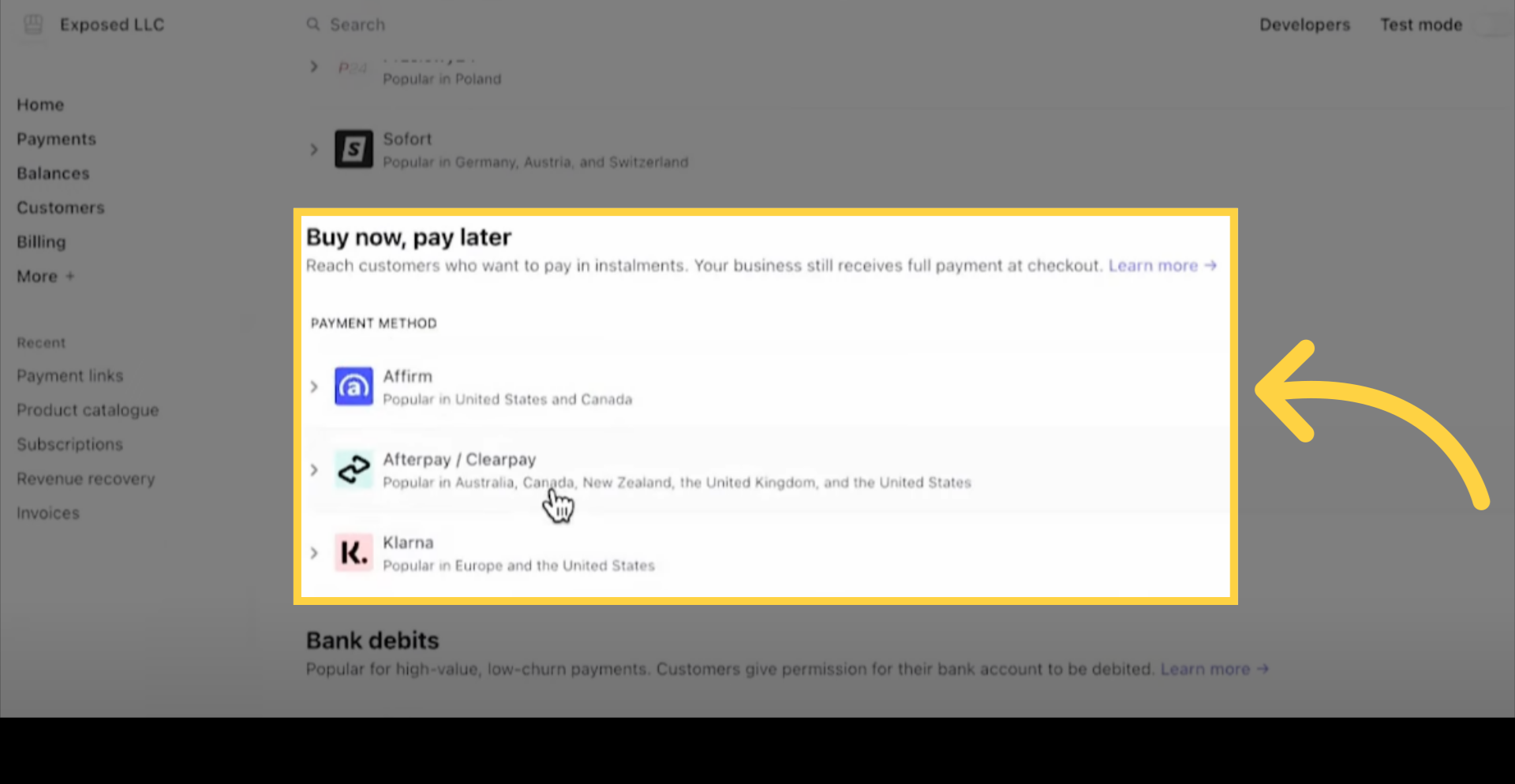

Buy now, pay later methods let customers pay in installments over time. You’re paid immediately and in full and your customers pay nothing or a portion of the total at purchase time. Buy now, pay later methods are often used by:

Retailers selling high value goods and services like luxury items or travel fares that want to boost conversion.

Retailers selling low value goods and services that want to increase average cart size and reach new customers who might not have credit cards.

Regional banks that allow consumers to split credit card payments over multiple billing cycles.

Your customers are businesses. Buy now, pay later methods offered on Stripe are only supported for consumers.

Your business relies on subscriptions or recurring purchases. Buy now, pay later methods don’t currently support Invoicing or Subscriptions.

Go to stripe.com

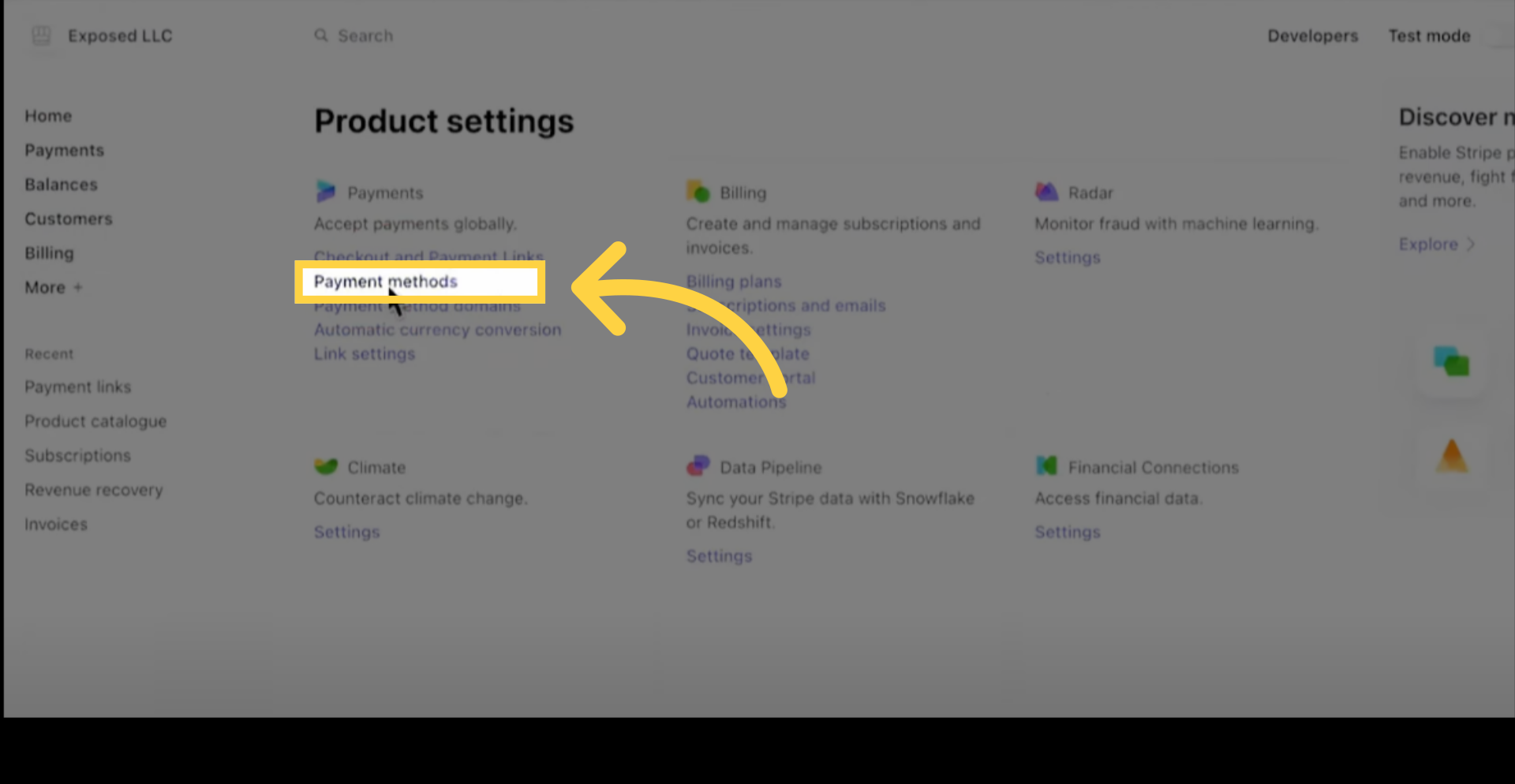

Log in to your Stripe account and navigate to Payment section.

Under product settings, look for payment method.

Look for buy now, pay later tab and select the payment option you wish to activate.

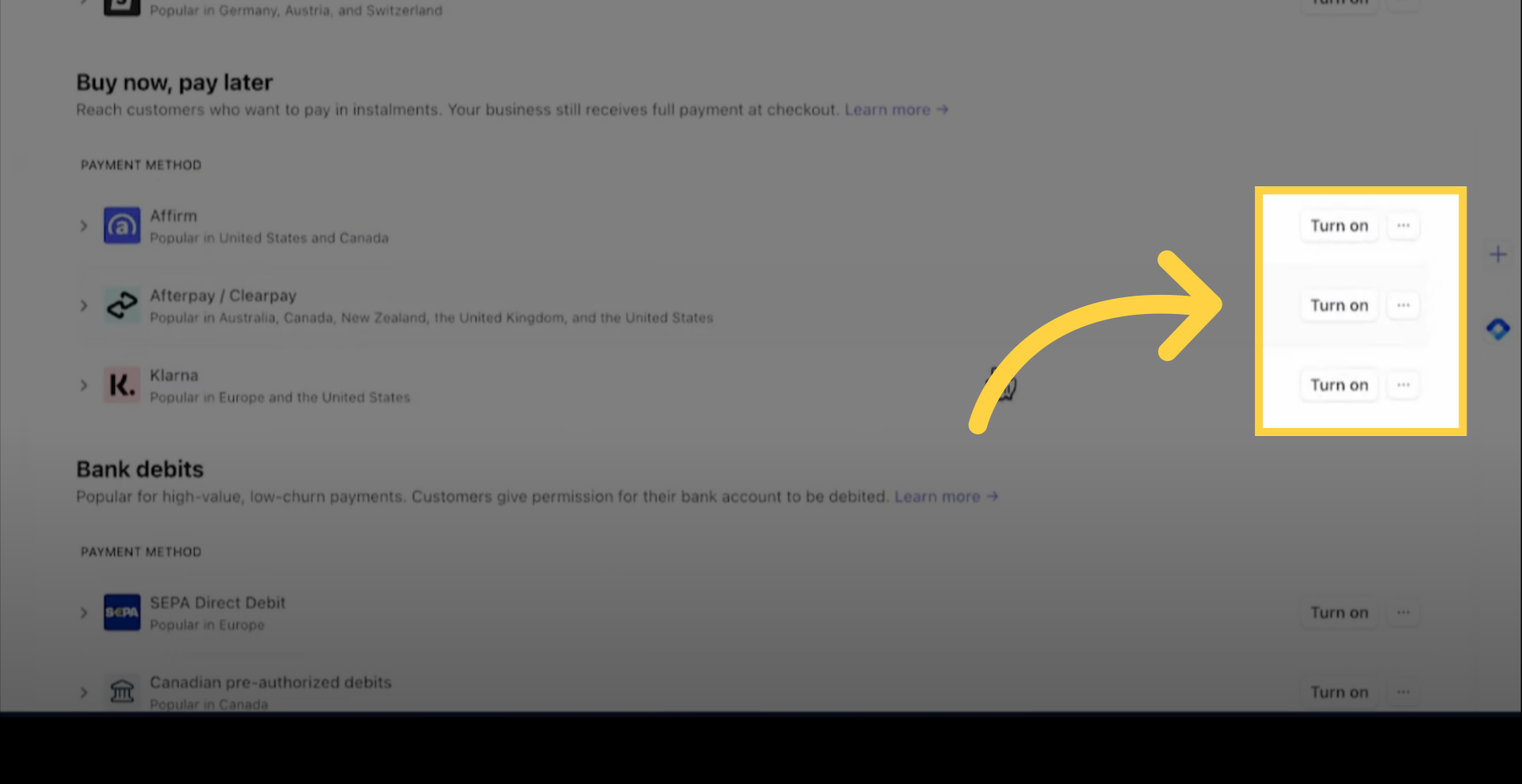

Turn on, to activate the payment method

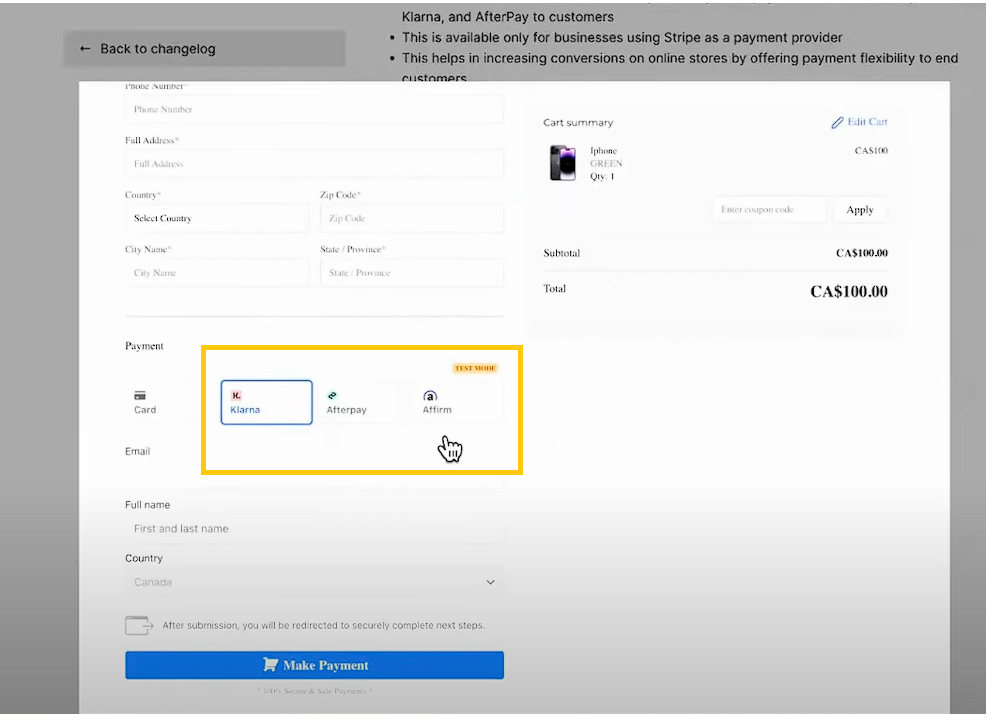

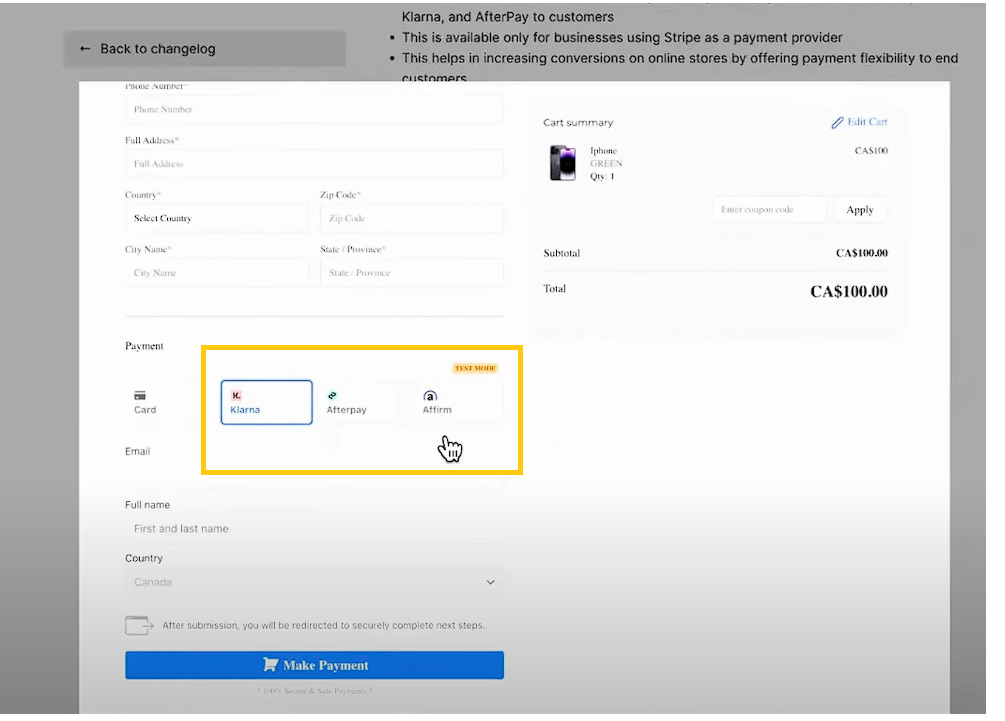

On your payment page, you will be able to use three different payment methods once this feature has been activated.

Once the purchase is complete, businesses receive the full payment up front (minus any fees). Customers pay their installments directly to the buy now, pay later provider, often with no interest and no additional fees when they pay on time.

Note:

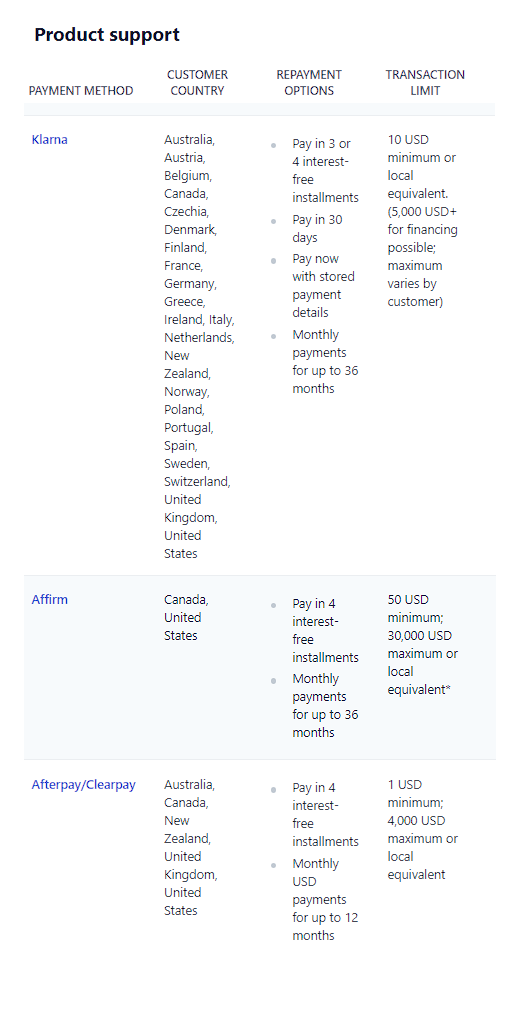

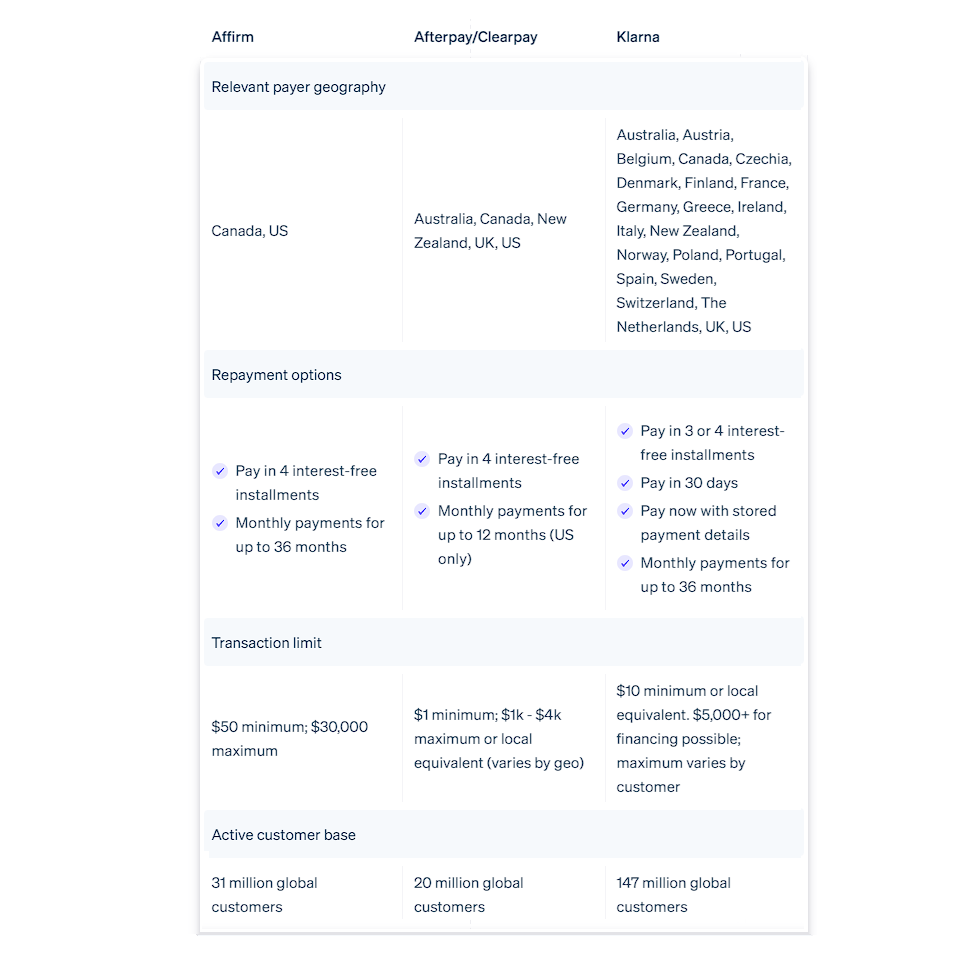

Selecting the right buy now, pay later provider depends on the types of items you sell, the price of those items, and your customer base. When evaluating providers, consider the following:

Repayment terms: Buy now, pay later providers offer different installment plans and term lengths, ranging from a few weeks to multiple years. If your business typically has a high average order value, look for buy now, pay later providers that offer repayment over a longer period of time (like having customers pay monthly installments over six months). On the other hand, businesses with a lower average order value may be able to offer fewer installments over a shorter amount of time, like four installments over six weeks.

Credit limits: Every customer will have a different spending limit based on their usage, credit, and/or repayment history, but some buy now, pay later providers have minimum and maximum credit limits. Again, evaluate your average order value and select a provider that offers enough credit for customers to successfully make a purchase.

Customer location: Decide in which markets you’d like to offer a buy now, pay later service based on where your customers are located. This may mean offering more than one buy now, pay later provider to maximize your geographic coverage. You may also want to select the buy now, pay later provider that is most popular in the region; for example, Afterpay and Zip are the most popular buy now, pay later services in Australia, while Klarna is most popular in Germany and the Nordics.

Find relevant buy now, pay later services by reviewing the profiles of Stripe-supported options below. You can also see which payment methods are available for your account.

As long as customers are careful not to overspend and continue to make payments on time, most buy now, pay later payment methods shouldn’t significantly impact a customer’s credit score.

However, credit scores may be impacted if providers run a hard credit check or if a customer fails to make payments on time.

Buy now, pay later services generate revenue by charging fees to both customers and businesses. Business fees will depend on the provider, but will normally include a fee for the initial setup process and a fixed fee for each transaction. Customer fees are generally related to interest charges or late fees for missing payments.