With our refund processing feature, businesses can manage refunds for transactions made through multiple payment providers, including Stripe, Authorize.net, NMI, and PayPal. A variety of payment methods are supported, including Google Pay, Apple Pay, and credit cards. This feature allows you to:

Process full or partial refunds for transactions, giving businesses flexibility in handling customer refunds.

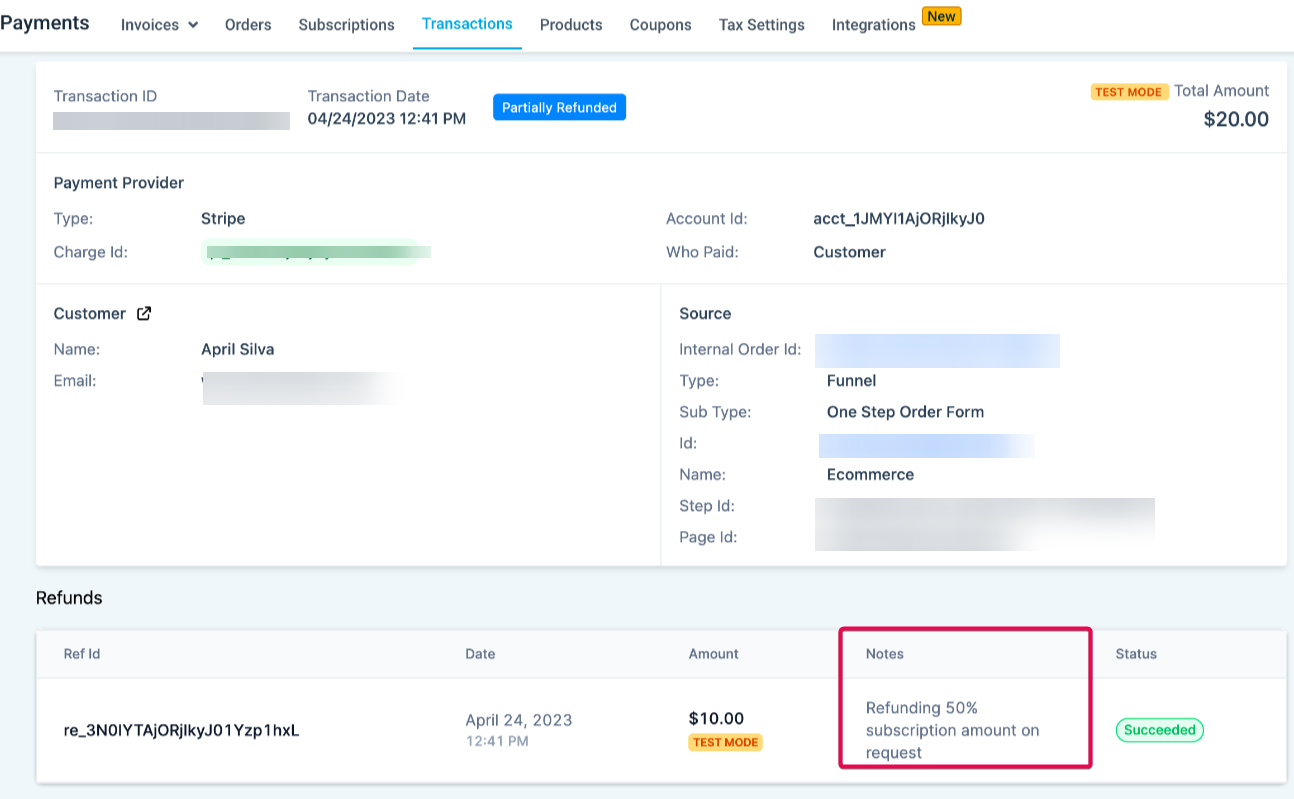

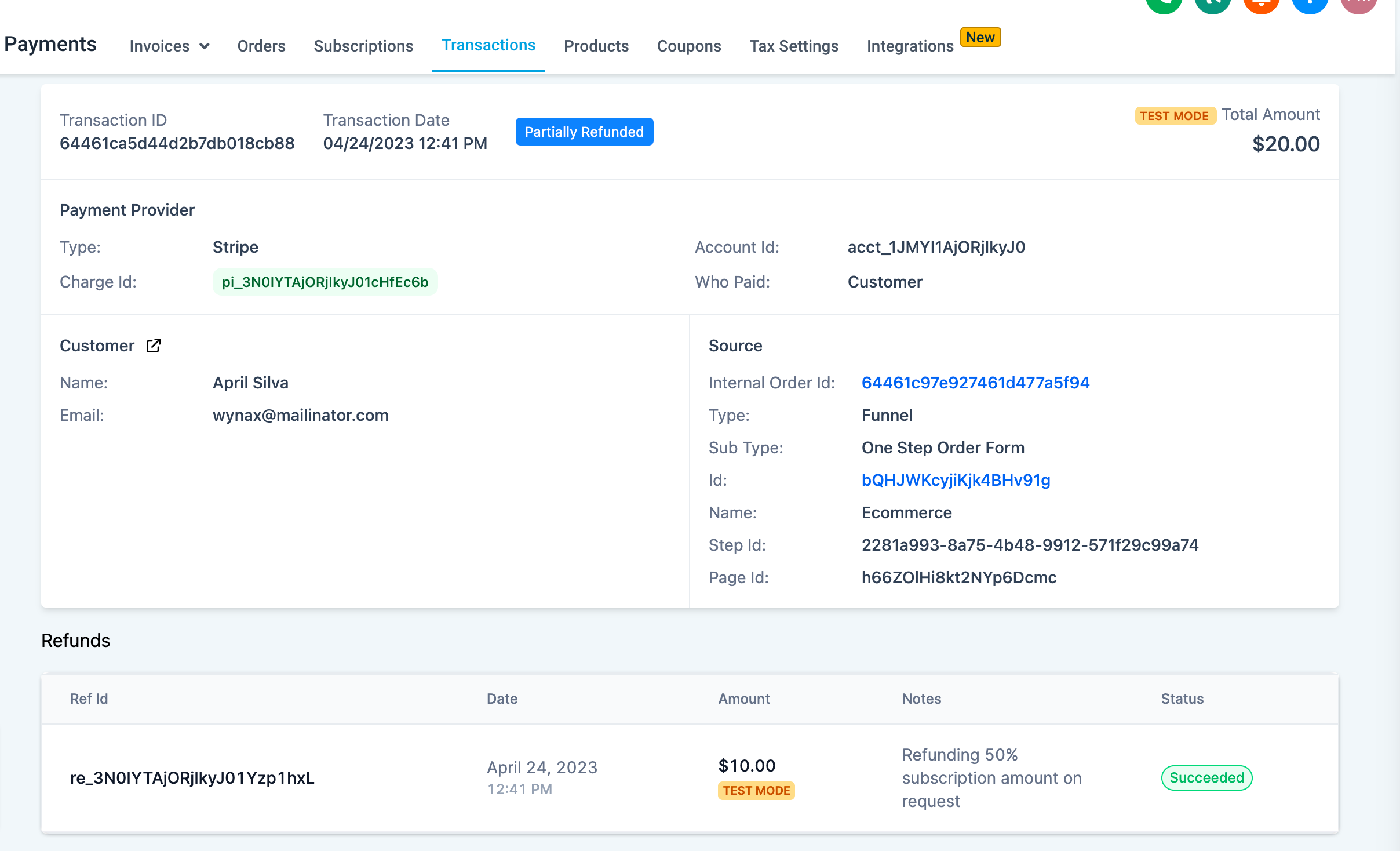

Track successful and failed refund attempts on the Transaction Details page, enabling businesses to monitor refund history and amounts for specific transactions.

Easily manage refunds for various payment providers and methods from one central platform, streamlining the refund process and reducing manual effort.

Please Note:

There are a variety of uses for refund processing:

Resolving customer disputes: This feature allows businesses to quickly and efficiently process refunds for unsatisfied customers, improving brand trust and satisfaction.

Addressing billing errors: Businesses can use this feature to issue refunds promptly to customers who have been charged incorrectly or multiple times. This ensures a smooth customer experience and reduces negative feedback.

Handling order cancellations: Businesses can process refunds efficiently when a customer cancels an order or service, reducing administrative effort and waiting times.

Managing returns and exchanges: When customers return products or request an exchange, businesses can refund the original purchase amount and facilitate a new transaction for the replacement.

Offering discounts and promotions: It allows businesses to offer partial refunds to customers in cases where discounts and promotions weren't applied correctly.

Supported Payment Providers

The refund action is available for all payment providers (Stripe, Authorize.net, NMI, and PayPal)

There is no option as of now to refund the subsequent recurring transactions from subscriptions.

Steps to issue a Refund:

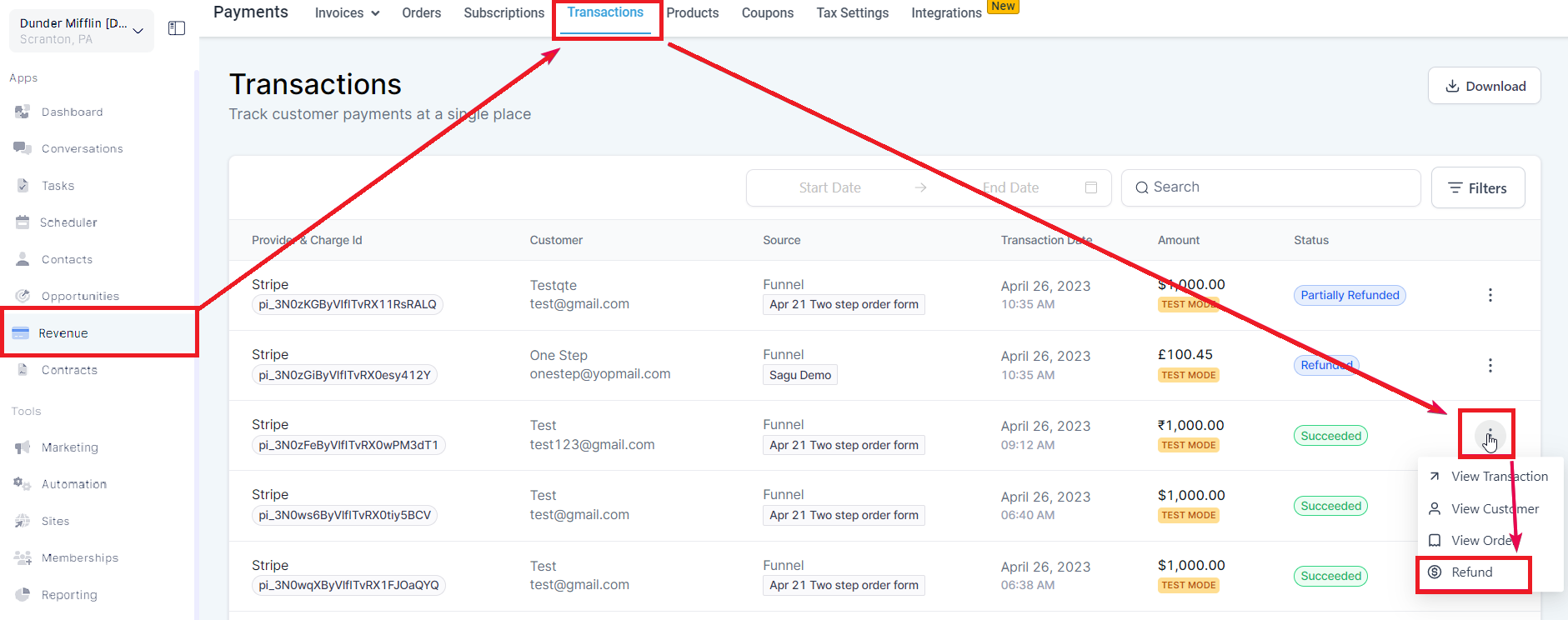

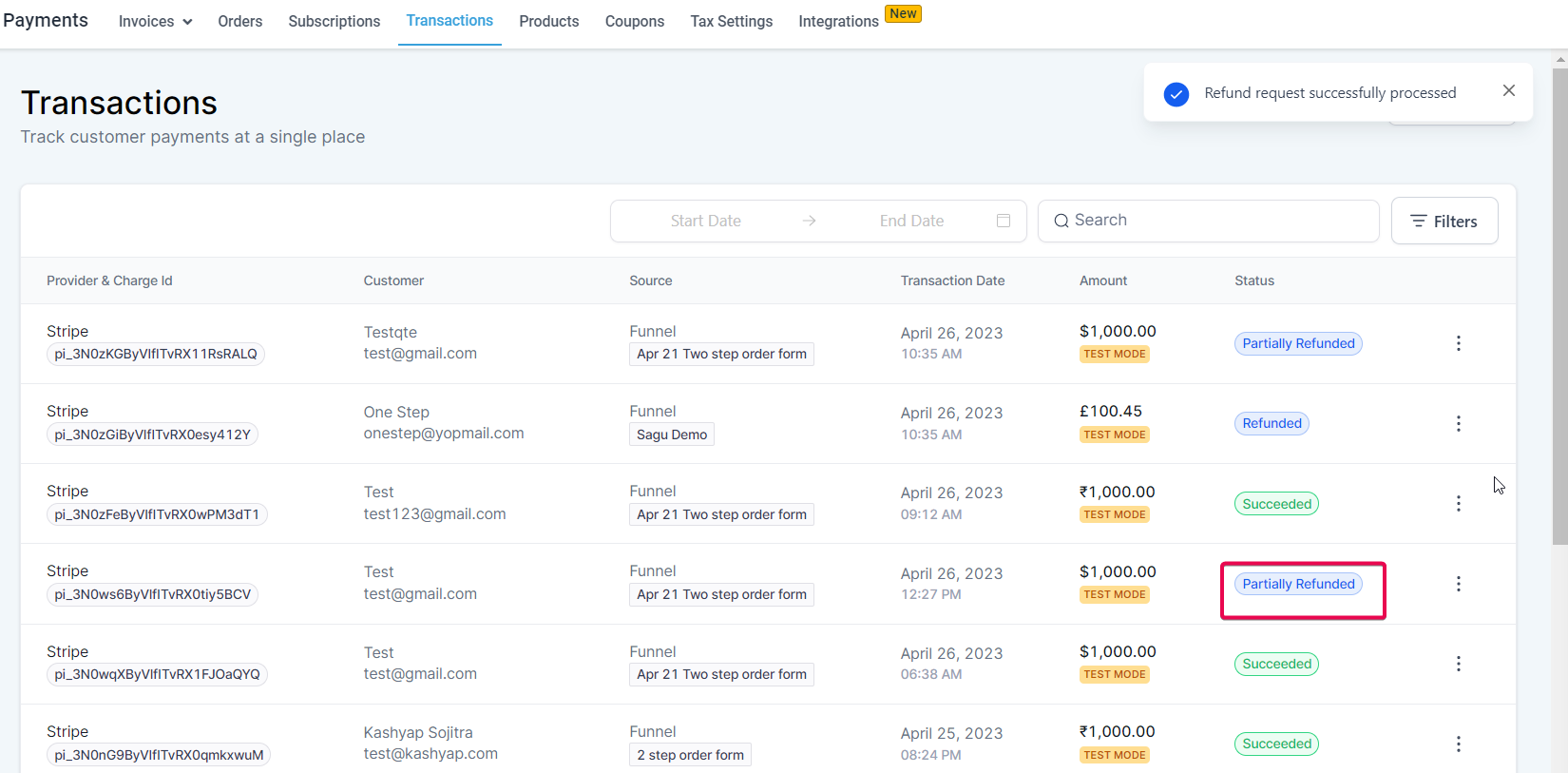

Head to "Revenue" > "Transactions" > Click on the three dots next to the payment you want to refund> then click on "Refund".

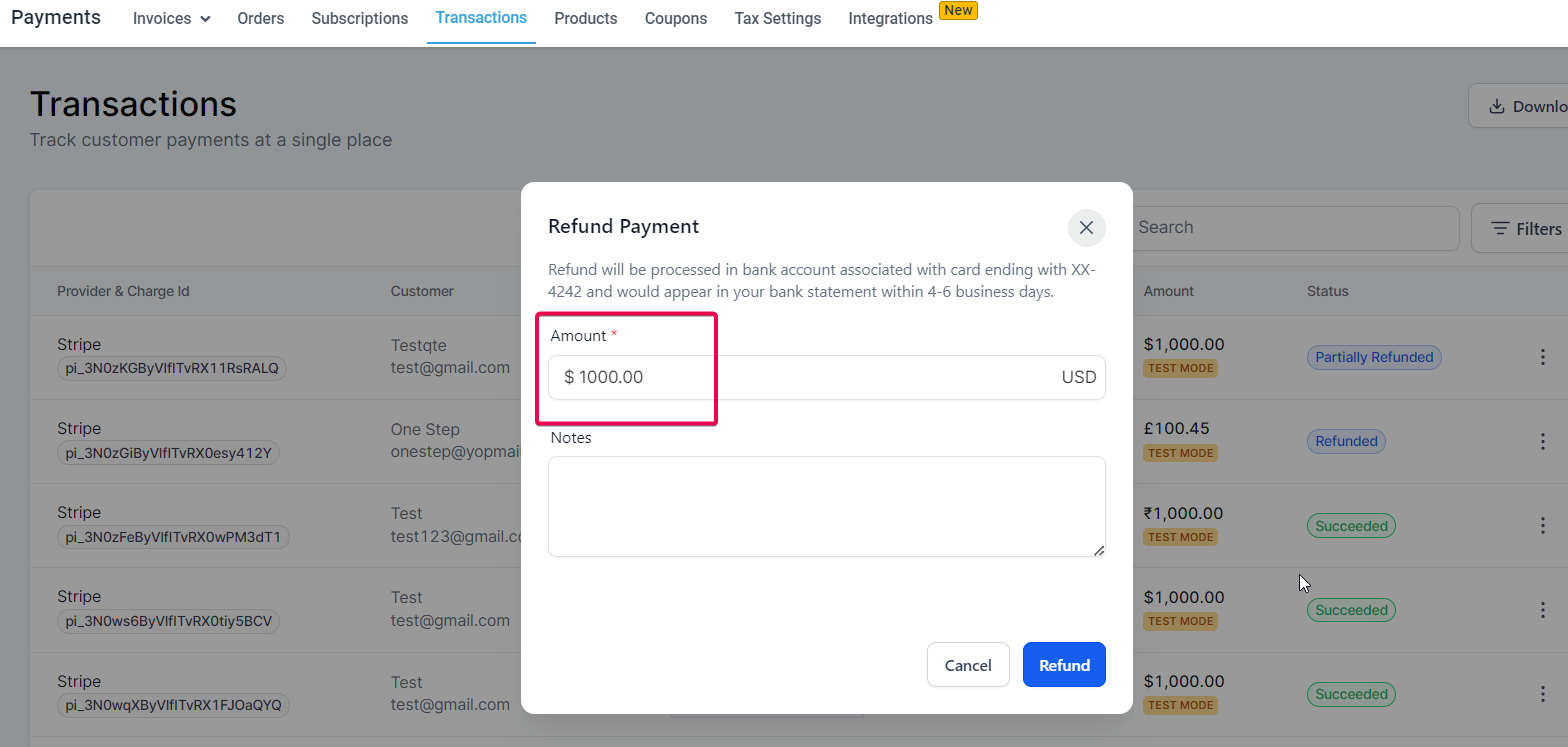

Full Refund

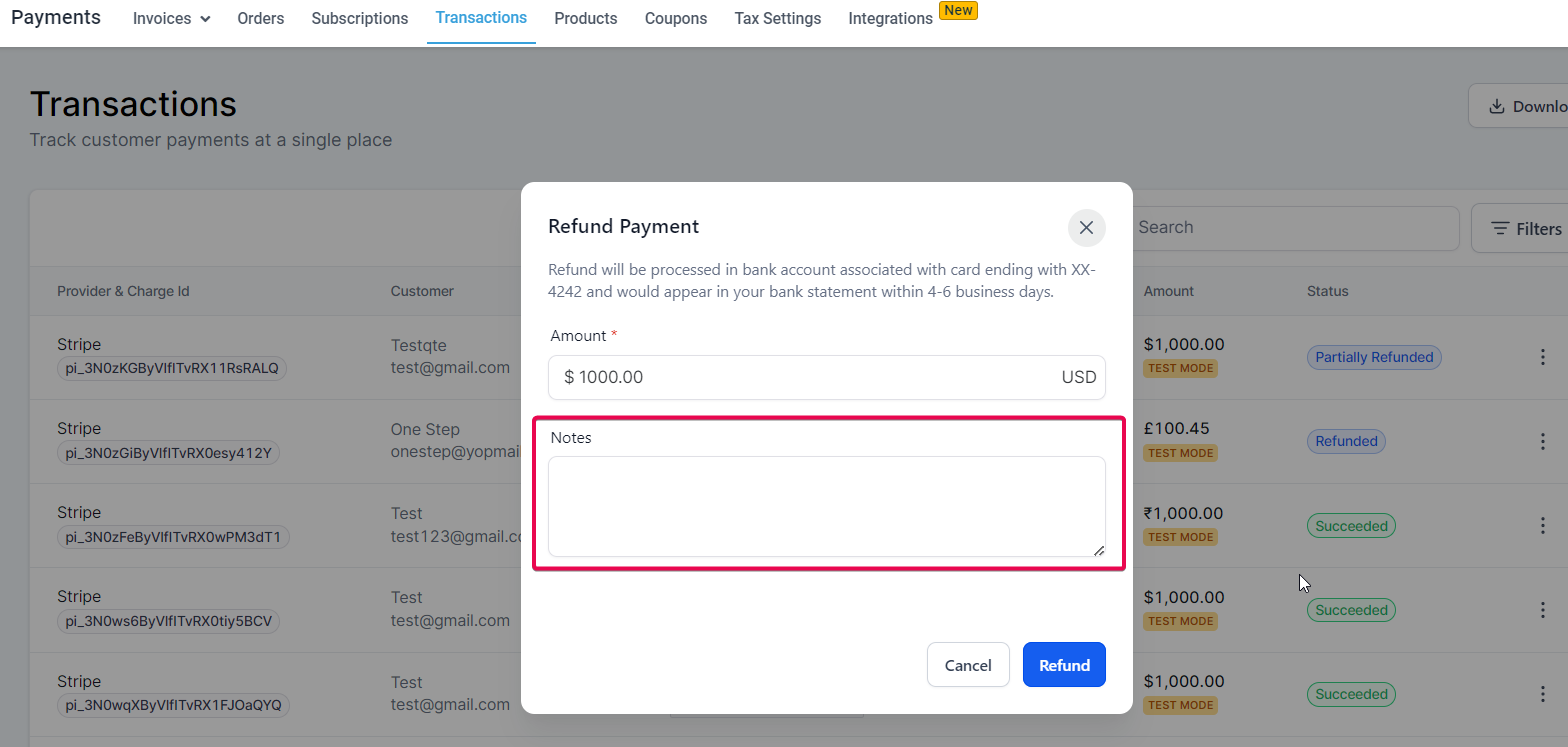

A full refund will automatically pre-populate the total amount of the transaction in this window:

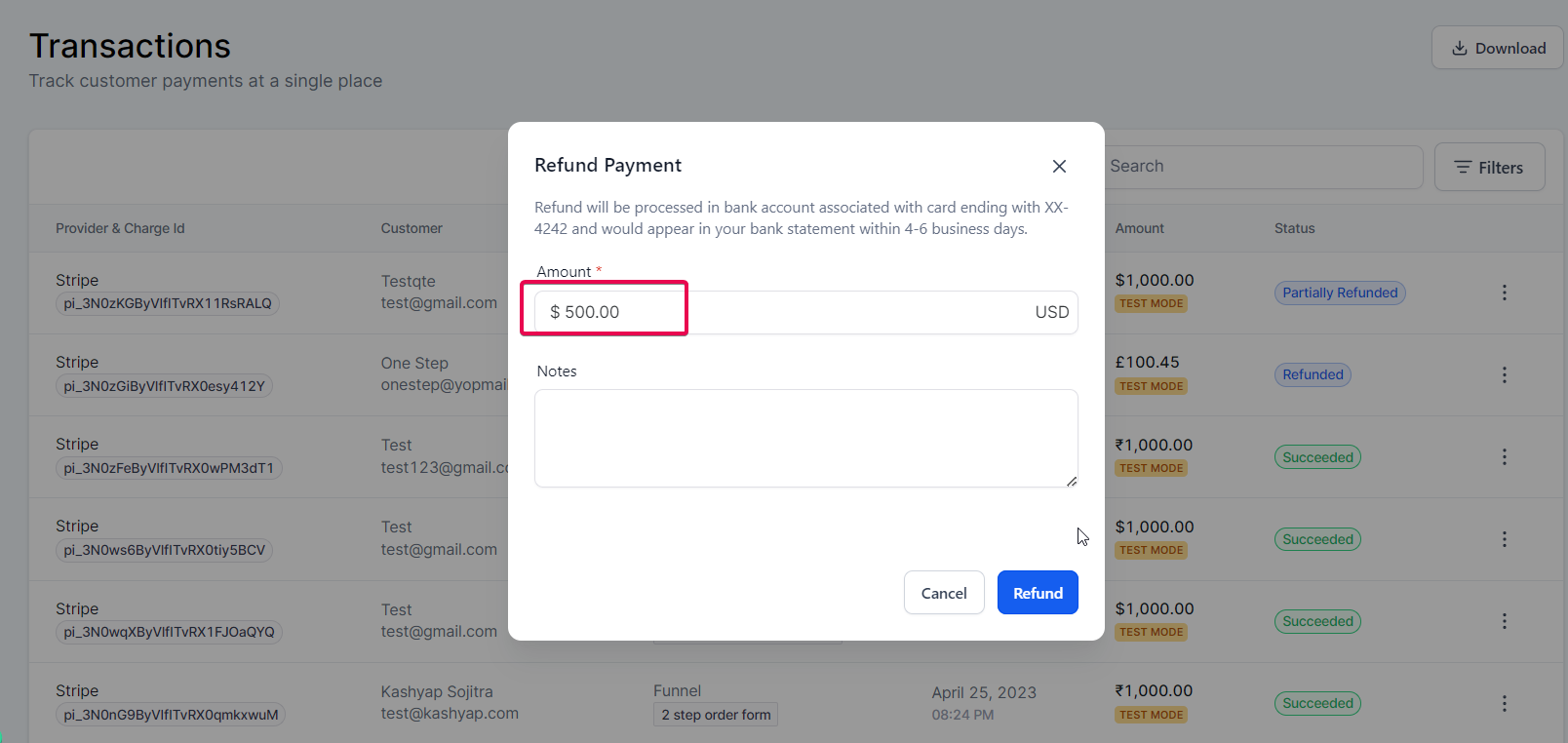

Partial Refund

You can edit the pre-populated amount to anything less than the Full amount of that transaction if you want to issue a Partial Refund.

Please Note:

The partial refund feature can be valuable in various usage cases:

Adjusting for pricing errors: If a customer was charged the wrong price for a product or service, businesses could use the partial refund feature to return the difference between the incorrect and correct price, ensuring the customer is fairly charged.

Offering post-purchase discounts: Businesses may apply a particular discount or promotion to a customer's purchase after processing the transaction. A partial refund can be issued to provide the customer with the intended savings.

Resolving disputes with a compromise: In cases where a customer is not entirely satisfied with a product or service, but the business and customer agree on a fair compromise, a partial refund can be issued to reflect the agreed-upon resolution.

Handling partial returns: When a customer returns only part of an order, businesses can use the partial refund feature to refund the value of the returned items without affecting the remaining portion of the order.

Compensating for damaged or missing items: If a customer receives an order with damaged or lost items, businesses can issue a partial refund to compensate for the inconvenience and value of the affected items.

Reimbursement for shipping costs: In cases where a customer has experienced shipping issues or delays, businesses may issue a partial refund to cover the shipping costs as a gesture of goodwill.

A: The Transaction details page will display all successful/failed refund attempts. In this way, you will be able to keep track of all the amounts which have been refunded within a specific transaction.

A: It is likely that this is happening because the refund does not meet the credit refund criteria set by the payment provider. Authorize.net does not allow refunds until 24 hours after the transaction. Refunds for older transactions are subject to payment provider policies and any specific time limits they may have. Refer to your payment provider's refund guidelines or contact their customer support team for clarification.

A: If the cumulative refund amount does not exceed the original transaction amount, you can process multiple partial refunds for a single transaction.

A: Yes, Google Pay and Apple Pay transactions and card payments can be refunded. Refunds will be made to the corresponding bank account associated with the Card or Google/Apple account.

A: The amount of time it takes for a refund to appear in a customer's account varies depending on the payment provider and the customer's bank. It may take up to six business days for the refund to appear in the customer's account.

A: There is typically no fixed limit to the number of refunds you can process daily. However, it's essential to check with your payment provider to confirm if they have any specific limitations or requirements for processing refunds.

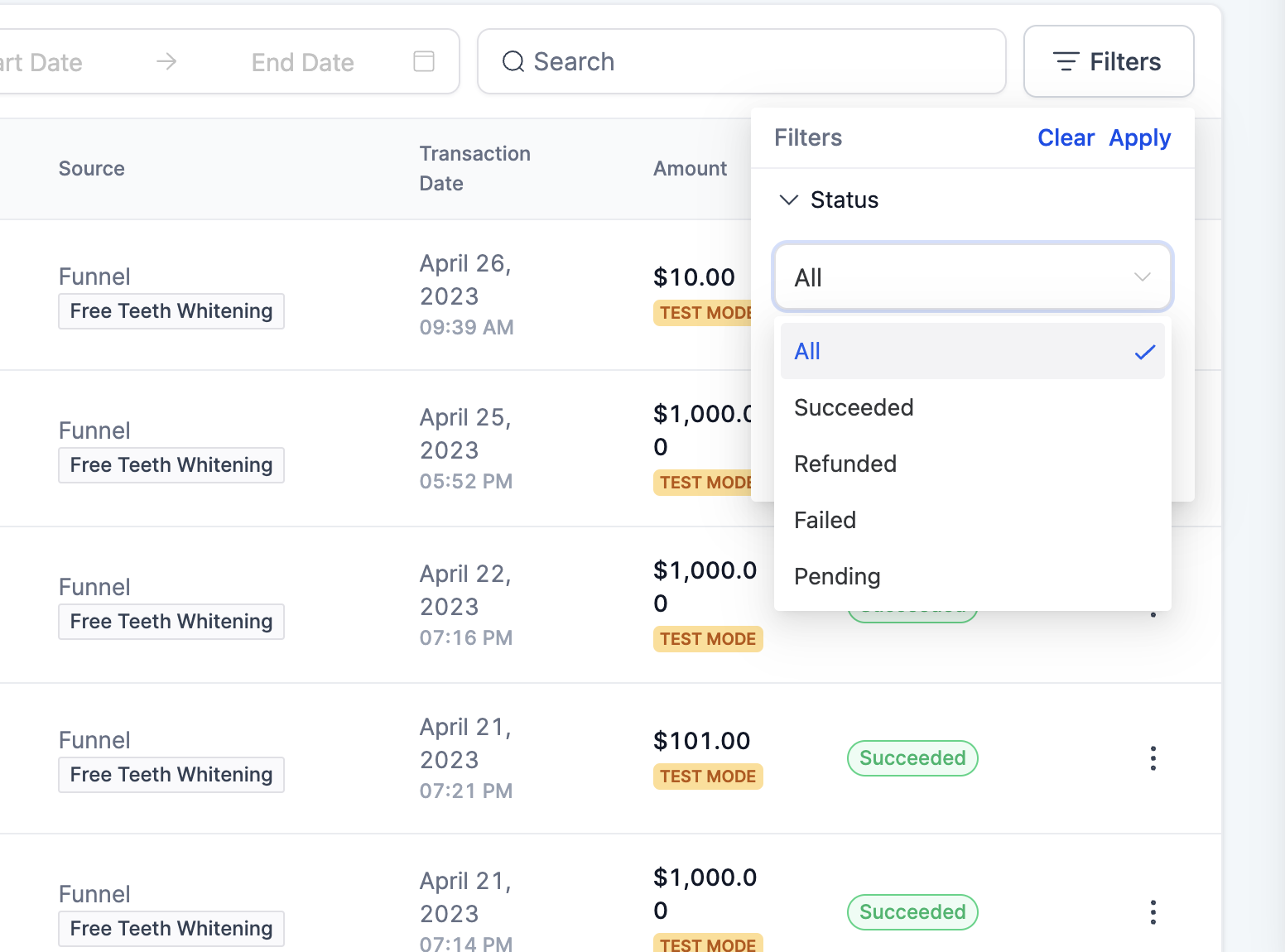

A: Currently, refunds cannot be processed using user permissions. Refunds within a transaction can be identified by checking the transaction details. User-specific permissions are on our to-do list. The direct filter on the Transactions table allows businesses to filter refunded transactions.