What's New

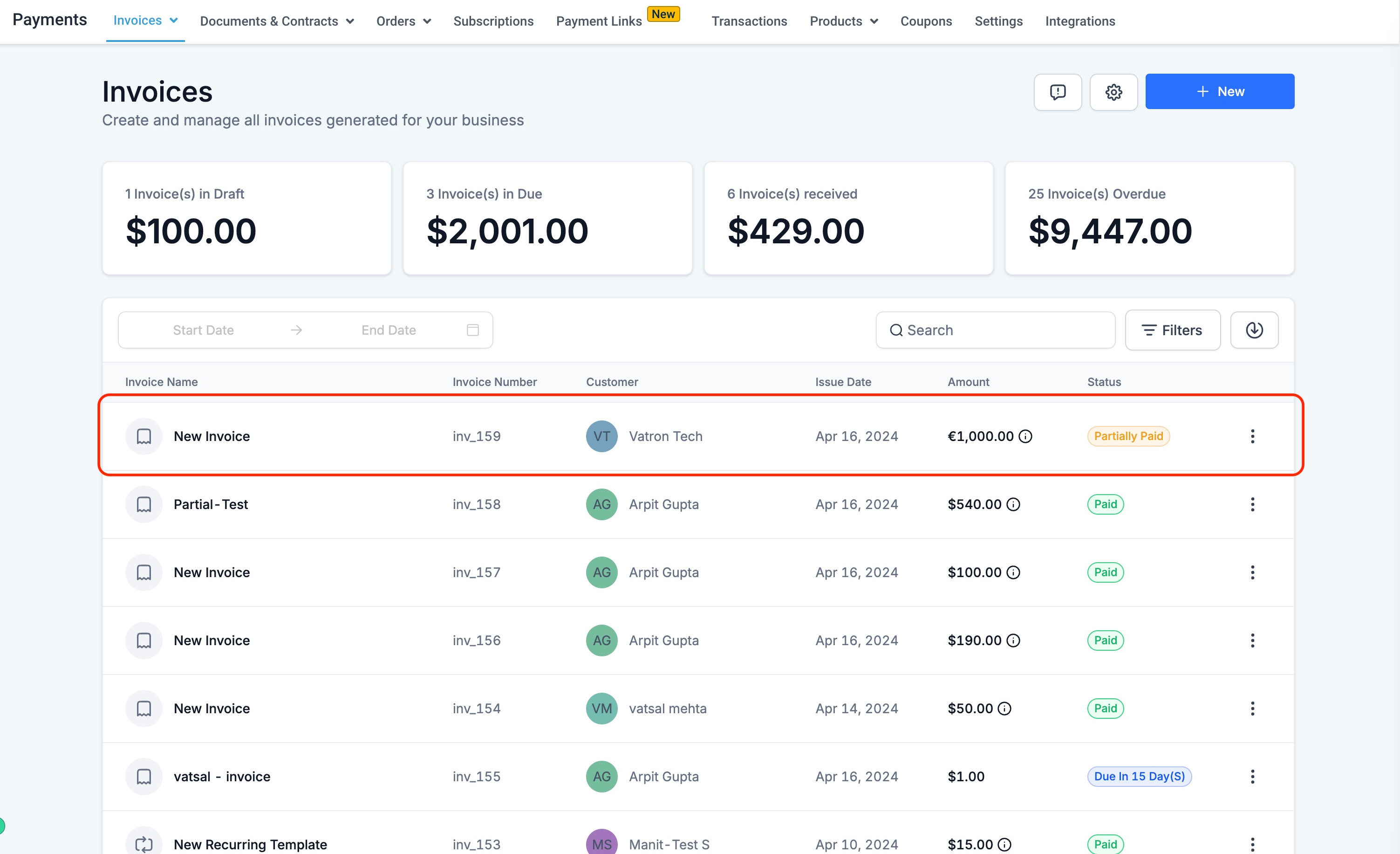

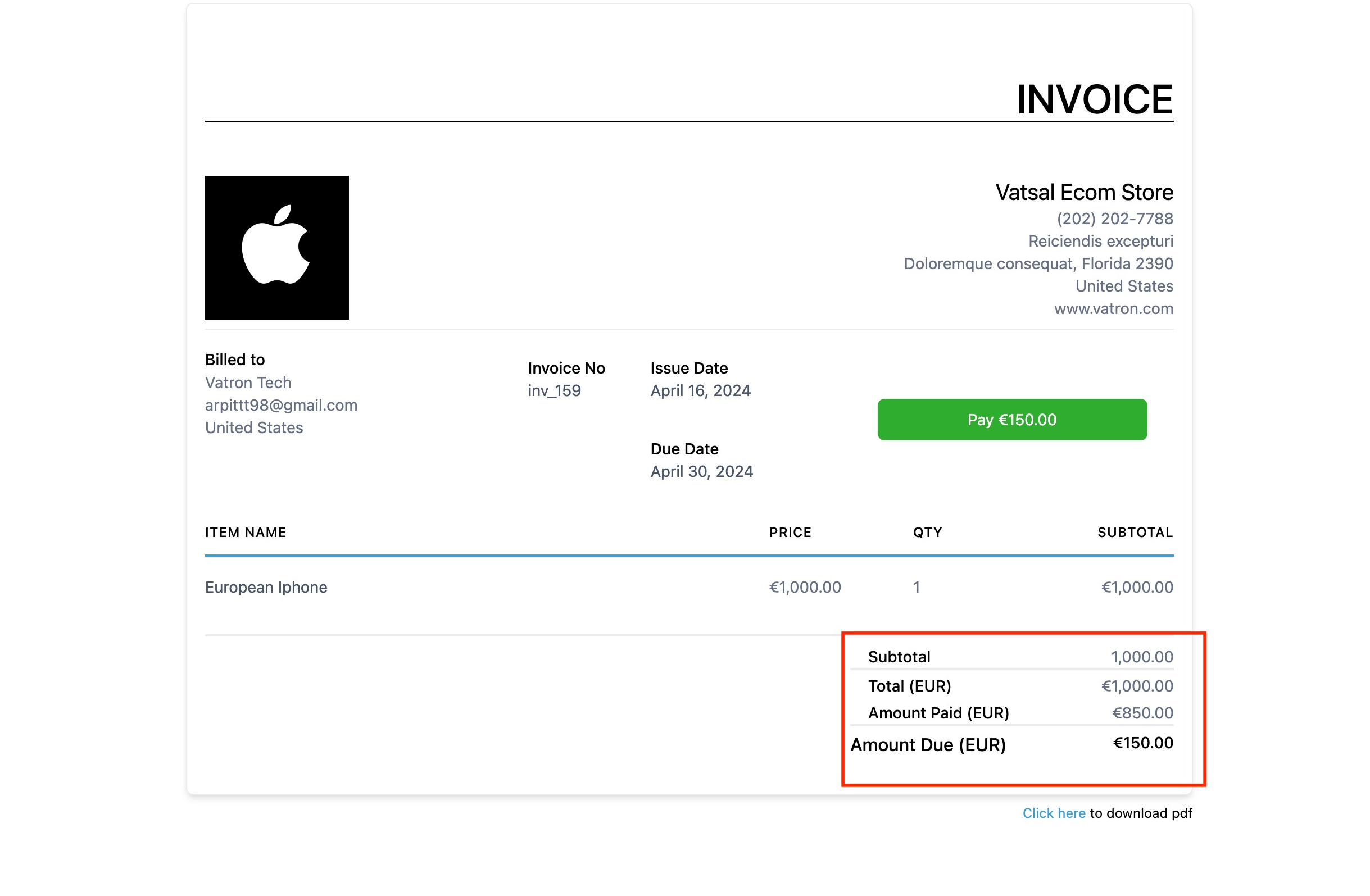

Previously, End Users or Customers could only accept full payments through the Invoices. The end customer was not allowed to make partial payments. Business Users can now set a minimum percentage of the total invoice amount to be collected from end customers with this updated feature.

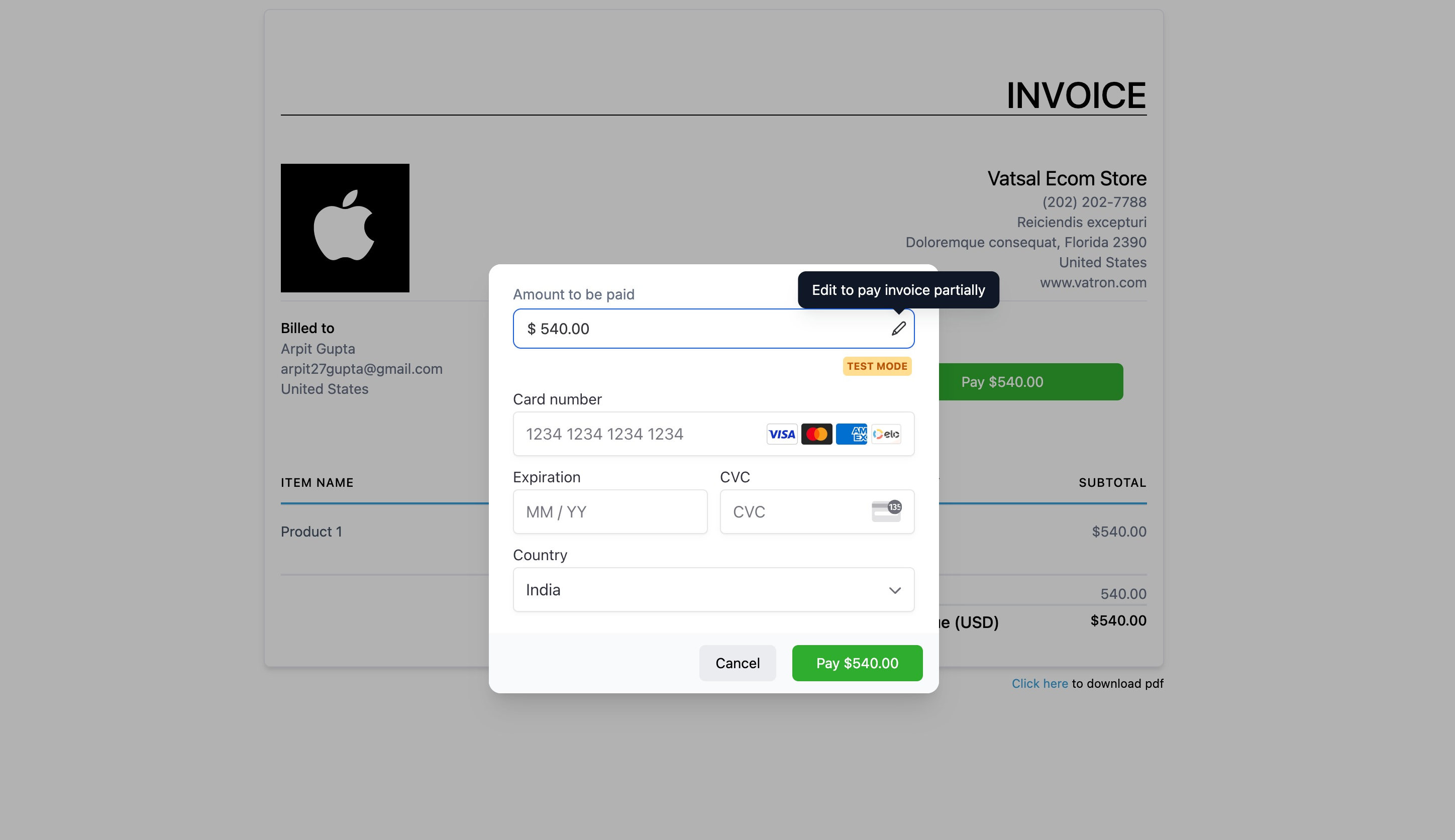

The customer can pay any amount that is equal to or greater than the percentage amount specified from the Invoicing Dashboard of the account.

Feature available for both one-time and recurring invoices.

With this feature, business owners are able to gain more control over how their customers pay, as well as capture more payments from their clients.

Note: For recurring invoices, partial payments are available for invoices with autopayment disabled. A customer card with autopayment enabled will have the option for partial payment for the first invoice, but the full amount will be auto drafted for subsequent invoices.

With this feature, businesses can set minimum percentages for invoice payments, empowering them with greater flexibility and control over payment plans, ultimately enhancing client payment capture rates.

Integrate a payment gateway (Stripe / Authorize.net / NMI).

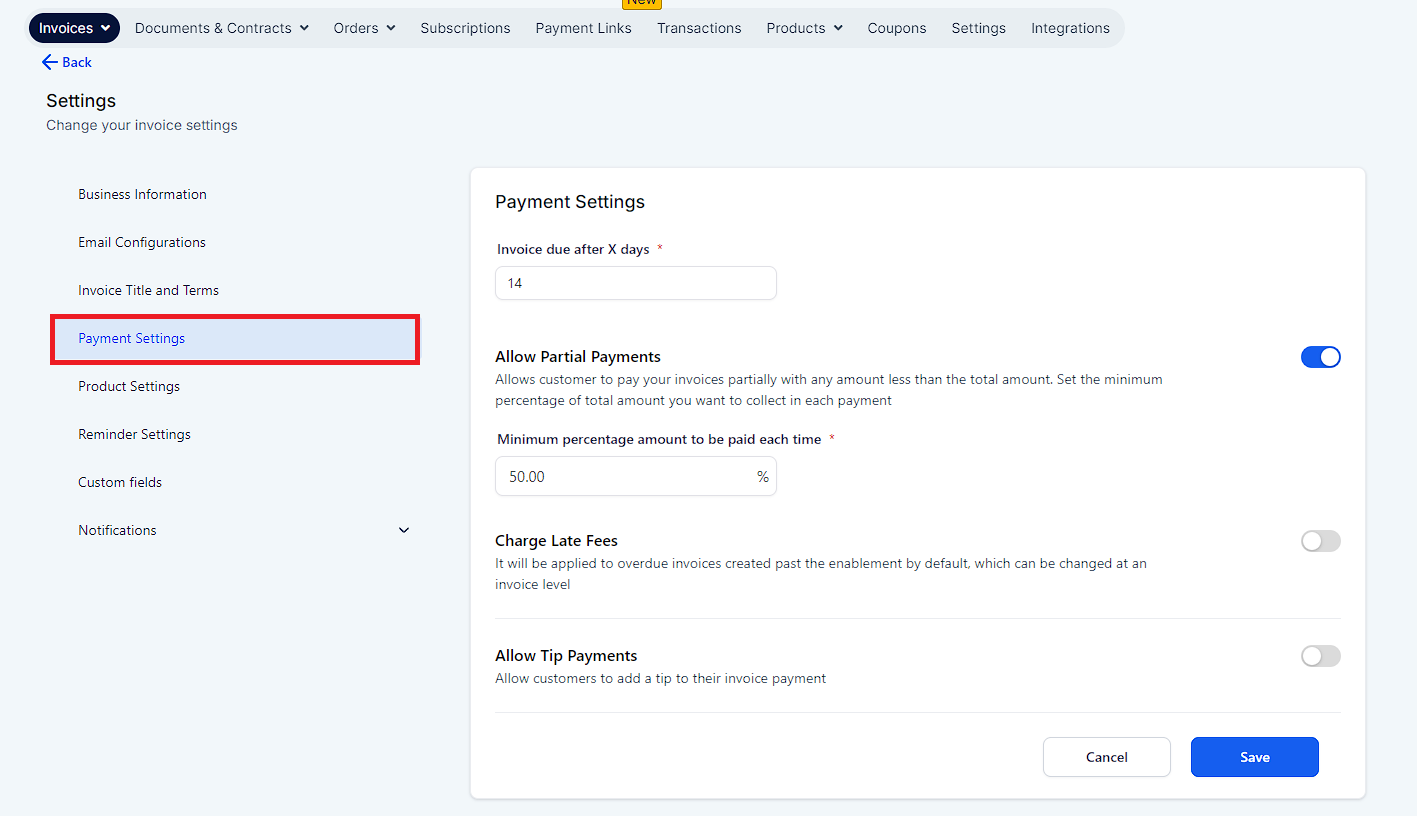

Navigate to "Revenue" > "Invoices" > "Invoices Settings".

On this page, click Payment Settings and enable Partial Payments

You can enter a percentage in the input field (the percentage is calculated based on the total amount of the invoice).

You are now able to make partial payments by clicking on "Save".